|

| leading the way to the

new storage frontier | |

... |

| ..... |

|

industrial

SSDs - boring right?

after AFAs -

what's the next box?

DWDP - examples from

the market

3D

nand fab yield - the nth layer tax?

how fast can your SSD

run backwards?

who's

who in the SSD market in China?

capacitor

hold up times in 2.5" military SSDs

where are we

heading with memory intensive systems?

miscellaneous

consequences of the 2017 memory shortages |

|

| ... |

|

2017 - adding new notes to

the music of memory tiering

by

Zsolt Kerekes,

editor - November 14, 2017 |

I think that developments in the SSD and

memory systems markets in 2017 will have as profound an effect on the future of

the data systems market and the direction of its architecture and software as

the adoption of flash SSDs in enterprise storage had on the design of

hard disk arrays and the

design of server motherboards.

Although many of the influences to this

new fork in the road had been nurturing for several years before this for

example:-

- competing software solutions for memory tiering

- the availability of 3 to 5 nvm alternatives to flash, and

- mainstream market acceptance of solid state storage at the heart of

enterprise storage engineering

it was the accidental convergence or

crashing together of alt nvms as usable modules (in DIMMs, M.2 SSD and PCIe

SSD form factors) in the same year as the

statistically

inevitable but accidental and unpredicted market force - the shortage of

flash (with its attendant price hikes which had the effect of making alt-nvms

look 2 -3 years better and more competitive than they had been in the all the

years before) - which made the lasting difference. From here on thinking about

the internal make up and external presentation of memory systems would be

materially different.

After

2017 - memoryfication solutions (tiering at the board, box and cloud level)

will no longer be restricted to the same old tunes restricted by the paucity

of melodies obtainable from DRAM, flash and the intervening interface

dynamics. After

2017 - memoryfication solutions (tiering at the board, box and cloud level)

will no longer be restricted to the same old tunes restricted by the paucity

of melodies obtainable from DRAM, flash and the intervening interface

dynamics.

Designers can now count on a new set of notes and

arrangements to provide data harmonies which were hitherto extravagant to

realize with the two old mainstay memory technologies with their well understood

limitations of space, power consumption and raw latency. (Although many

pioneering attempts at breaking these memory opera barriers came with a

supporting cast of batteries and extra cooling technologies hidden behind the

stage curtain.)

While no one can guarantee that MRAM, ReRAM or 3DX /

Optane will all continue to be available and competitive in multiple future

generations - the continued future existence of any one particular alternative

to flash and DRAM is less significant than the balance of probability that there

are enough technologies out there (and coming in the works) to make it

worthwhile for software and hardware designers to apply their minds to enriching

the vocabulary of their architecture song books.

If I can use another

analogy - 19th century chemists made great strides in their anticipation of all

possible elements when they constructed the periodic table. For over a decade

the SSD market (and its SSD product atoms) has been both enabled but also

limited by the combination of building blocks which designers could construct

with 2 distinct memory types - subject to the constraints of the atomic forces

(price, wattage and ratios of capacity and latency between DRAM, flash and all

rotating storage) which set the boundaries of which architectural permutations

of components were viable at any point in time.

Looking ahead - the

availability of new memories in the mix and the willingness of designers to

leverage their features to create virtualizable benefits could be as

significant to the datasystems market as the advent of additive technologies (3D

printing) to the creation of new materials with characteristics which weren't

imaginable with traditional elements and compounds. | | |

|

| ... |

|

|

|

... |

|

| One of the comforting

things about the industrial SSD market before 2017 was that products didn't

change much from one year to the next. But new applications and technologies for

rugged SSDs will change that picture. |

| say

farewell to reassuringly boring industrial SSDs | | |

|

... |

|

|

|

|

... |

|

|

|

... |

|

|

|

|

... |

|

|

|

| |

|

|

| ... |

|

| ... |

|

more pages like

this? |

| ... |

Next Platform reports on big NVMe ideas

seen at SC17

Editor:- November 28, 2017 - Newisys (whose 15 million IOPS, 60GB/s

2U rackmount NVMe SSD platform with Intel's Optane inside

won an award at last summer's Flash

Memory Summit) is one of several companies mentioned in a new

article -

Assessing

the Tradeoffs of NVMe Storage at Scale (a report on

SC17 in the Next Platform)

written by its Senior Editor - Jeffrey

Burt who has written

many articles about high

performance storage.

Everspin says it will make STT-MRAM more competitive

Editor:-

November 15, 2017 - A

story

on MRAM-info.com says that Everspin has decided

to delay the introduction of its 1Gb STT-MRAM devices and instead focus on its

256Mb chips which are already in production.

In Everspin's recently

announced

financial results press release the company's CEO said the company is

progressing from being "a developer of innovative MRAM technology into one

that can develop markets, scale operations and reduce costs to compete..."

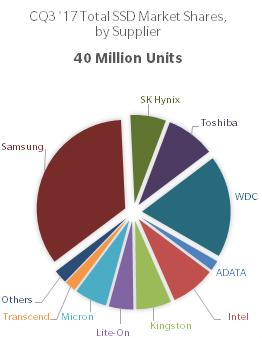

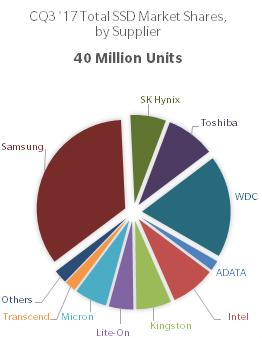

PCIe SSDs (enterprise and notebook M.2) did well in Q3

Editor:-

November 15, 2017 - TrendFocus

today published

SSD

market shipment data for Q3 2017.

Only one segment, enterprise

PCIe, saw unit growth where every other segment – client drive format

factor, client modules, enterprise SATA and enterprise SAS, all declined from

the prior quarter.

The

enterprise SSDs market declined 7% Q-Q, which includes

SATA,

SAS and

PCIe. The bright spot

within this overall decline was the healthy 15.6% increase in PCIe units. As

hyperscale companies continue to migrate away from SATA, PCIe should continue to

grow in both units and exabytes. SATA, still the highest volume of all

enterprise categories, managed to stay just above 4 million units shipped but

did decline sharply in CQ3. However, exabytes shipped in the SATA SSD market

grew due to the transition to higher capacity units. SAS SSDs now represent the

lowest unit volume of the enterprise SSD segments, but still maintain a large

lead in average capacity shipped at over 2.1 terabytes. The

enterprise SSDs market declined 7% Q-Q, which includes

SATA,

SAS and

PCIe. The bright spot

within this overall decline was the healthy 15.6% increase in PCIe units. As

hyperscale companies continue to migrate away from SATA, PCIe should continue to

grow in both units and exabytes. SATA, still the highest volume of all

enterprise categories, managed to stay just above 4 million units shipped but

did decline sharply in CQ3. However, exabytes shipped in the SATA SSD market

grew due to the transition to higher capacity units. SAS SSDs now represent the

lowest unit volume of the enterprise SSD segments, but still maintain a large

lead in average capacity shipped at over 2.1 terabytes.

Client SSD

shipments fell 4.5% sequentially but exabytes shipped was flat. Client modules

now represent almost 2/3 of all client SSDs shipped. Even more impressive within

this segment is that M.2

PCIe is now 50% of this segment – illustrating the continued migration for

major Notebook

OEMs to integrate with this interface.

3D NAND accounted for more than

50% of all bits shipped for the first time in CQ3, as all of the NAND suppliers

are well into the transition.

IntelliProp demonstrates Gen-Z memory controller

Editor:-

November 13, 2017 - IntelliProp

today

announced

demonstrations of 2 new controller IPs.

- A memory controller for the emerging Gen-Z memory interface.

IntelliProp's

Gen-Z IPA-PM185-CT "COBRA" controller combines DRAM and NAND and

sits on the Gen-Z fabric, not the memory bus. COBRA has the ability to support

byte addressability to DRAM cache and Block addressability to NAND flash.

COBRA-based Gen-Z memory modules provide low latency, persistent, shared memory

access to multiple processors and accelerators on the Gen-Z fabric supporting up

to 32GB of DRAM and 3TB of NAND.

- An NVMe 1.3 compatible host accelerator IP core.

IntelliProp's

IPC-NV164-HI for for Xilinx and Altera FPGAs accelerates performance by

off-loading command and completion queue management from the processor to

hardware.

Enmotus tiers NVDIMMs with NVMe flash at SC17

Editor:-

November 13, 2017 - Enmotus

today

announced

it is demonstrating a fully automated tiered volume with 2 million IOPS

performance using NVDIMMs and NVMe flash technology from Micron at the SC17

Conference being held this week in Denver, Colorado.

"Enmotus' FuzeDrive Virtual SSD Software combines the NVDIMMs and

NVMe flash into a single, fully automated virtual volume," said

Andy Mills, CEO of

Enmotus. "The software identifies the active data set of applications, and

dynamically allocates the appropriate storage resources to optimize performance."

Qualcomm invests in Excelero

Editor:- November 7,

2017 - Excelero today

announced

a strategic investment from Qualcomm Ventures which brings the total of VC funds

invested in Excelero to $30 million.

"NVMe SSDs and innovations

like 3DXpoint need new scale-out architectures so that IT teams can consolidate

resources enterprise-wide into flexible and reliable infrastructures, without

compromise," said Lior

Gal, CEO and co-founder of Excelero. "We're proud to receive the

ultimate vote of confidence from esteemed strategic investors such as Qualcomm

Ventures – leaders who are driving innovation in data center technologies.

We look forward to building out our offering and helping enterprises to deploy

the hyperscale data center of tomorrow."

SSD software,

VC funds in SSD,

after AFAs -

what's the next box?

AccelStor doesn't use capacitor holdup to boost new HA arrays

Editor:-

November 6, 2017 - The complex interdependencies between

capacitor

hold up time on

RAM flash caches

and performance

and reliability in

SSDs has been discussed many times in StorageSearch.com.

In an

announcement

today about its new 2U flash array for the

high availability

market - the

H510

(pdf) (array of 24 SATA SSDs with 8x 10GbE SFP+ or 4x 16G FC connectivity) -

AccelStor

said this...

"Some vendors adopt NVRAM as a write cache and use

supercapacitors to provide energy to write the RAM content into flash in the

event of a power failure. However, supercapacitors can still cause a single

point of failure. AccelStor aims to provide comprehensive data protection. With

the special write-through design, its NeoSapphire AFAs acknowledge the

completion of incoming I/O only when 100% of the data has been written on the

SSD."

AccelStor became known for their high performance arrays for

the performance

optimized market. The new H510 also includes data

security features

including cryptographic erase.

Many flash arrays includes some kind

of performance hit during software upgrades and maintenance. Accelstor says

its shared nothing architecture requires no maintenance window. "You can

simply perform the maintenance on a single node while receiving the full

performance and capabilities of the secondary node."

Editor's

comments:- I wrote about Accelstor's thinking about the use of NVMs and arrays

failover gotchas in

an interview

article last year. | |

| . |

|

|

| . |

|

| . |

|

| |

| .. |

|

|

.. |

|

|

|

.. |

|

SSD history is a mess.

I know I was there and I wrote the first draft of it.

But

there is an easy way to get the lessons of all that history of technical change

and market adoption by looking at 4 strategic before and after events. |

| strategic

bifurcations in SSD market history | | |

|

... |

|

|

|

.. |

|

.. |

|

| Are we

there yet? |

| After more than 20 years of writing guides to

the SSD and memory systems market I admit in a new blog on

StorageSearch.com -

Are

we there yet? - that when I come to think about it candidly the SSD

industry and my publishing output are both still very much "under

construction". ...read

the article | | |

|

.. |

|

| If you're one of those who

has suffered from the memory shortages it may seem unfair that despite their

miscalculations and over optimimism the very companies which caused the

shortages of memory and higher prices - the major manufacturers of nand flash

and DRAM - have been among the greatest beneficiaries. |

| consequences

of the 2017 memory shortages | | |

|

.. |

|

.. |

|

|

|

.. |

|

| after AFAs?

- the next box |

Throughout the

history of

the data storage market we've always expected the capacity of enterprise user

memory systems to be much smaller than the capacity of all the other attached

storage in the same data processing environment.

A

new blog on StorageSearch.com

- cloud

adapted memory systems - asks (among other things) if this will always be

true. A

new blog on StorageSearch.com

- cloud

adapted memory systems - asks (among other things) if this will always be

true.

Like many of you - I've been thinking a lot about the

evolution of memory technologies and data architectures in the past year. I

wasn't sure when would be the best time to share my thoughts about this one.

But the timing seems right now. ...read the

article | | |

|

|

|

| |

After

2017 - memoryfication solutions (tiering at the board, box and cloud level)

will no longer be restricted to the same old tunes restricted by the paucity

of melodies obtainable from DRAM, flash and the intervening interface

dynamics.

After

2017 - memoryfication solutions (tiering at the board, box and cloud level)

will no longer be restricted to the same old tunes restricted by the paucity

of melodies obtainable from DRAM, flash and the intervening interface

dynamics.