|

|

|

|

| Nimbus, founded in 2006, develops

award-winning Sustainable Storage systems, the most intelligent,

efficient and

fault-tolerant

solid state storage platform engineered for server and desktop virtualization,

databases, HPC, and next-generation cloud infrastructure. |

.... |

Combining low-latency flash

memory hardware, comprehensive data management and protection software, and

highly-scalable multiprotocol storage features, Nimbus systems deliver

dramatically greater performance at a significantly lower operating cost than

conventional disk-based primary storage arrays, all at a comparable

acquisition cost.

For more information, visit www.nimbusdata.com,

See also:-

Nimbus

- mentions on StorageSearch.com

Nimbus's news page

a winter's tale

of SSD market influences

Why size matters in

SSD design architecture | |

| . |

| after AFAs

- what's next? |

| Throughout the

history of

the data storage market we've always expected the capacity of enterprise user

memory systems to be much smaller than the capacity of all the other attached

storage in the same data processing environment. But will this always be true?

...read

the article | | |

| . |

|

| . |

| Who's who in SSD? - Nimbus |

by

Zsolt Kerekes,

editor - February 2013

Nimbus Data Systems is 1 of more than

100 companies in the

rackmount SSDs

market.

when did they enter the SSD market?

Nimbus

has been shipping SSDs in its racks since

2008 -

initially as accelerator options for its HDD arrays - and since January

2009 as pure

solid state storage. The company's internal hardware architecture is what I

call "open"

- in that it is based on RAID

like arrays of 2.5"

SAS SSDs which the

company designs itself and which use

eMLC. But

Nimbus doesn't sell SAS SSDs to other SSD array companies.

The company

is also 1 of many companies in these directories / market segments:-

rackmount SSDs,

iSCSI SSDs,

FC SANs,

Infiniband SSDs and

HA SSDs.

Top

SSD Company?

Nimbus made its debut in StorageSearch.com's list of

the

top 20 SSD companies

- in the 3rd quarter

of 2011.

In the most recent time-frame -

2nd quarter of 2013

- Nimbus was ranked #10 (it has been higher).

In

January 2013 -

the company

announced

it had been shipping at the rate of over 1

petabyte of SSD

storage / month. (That was back in the days when a petabyte of SSD was

considered to be a significant quantity. Looking ahead to 2014 that's the SSD

capacity you'll find in just 2U of

Skyera rackspace.)

enterprise

Silos?

Nimbus has never appeared in the

fastest SSDs list.

In my enterprise SSD

silo categories I think Nimbus is a good fit in the fast and the high end

of fast-enough rackmount SSD roles.

architecture and IP strengths?

SSD software is a

substantive differentiating IP asset of the company. The

HALO storage OS is

integrated in all its SSD racks.

The strong factors in Nimbus's SSD

architecture are its software - which in my view benefits from the company

founder's unique experience in developing unified SAN architectural concepts

for more than a decade. And by designing its own SSDs - Nimbus is able to

tweak system architectural features - such as performance (non blocking SAS

backplane), manageability (better integration with SSD controller data),

high availability (failover routing) and cost. The flash modules are about 80%

of the hardware.

You can see more detail in the article - "another

conversation with Nimbus - PCIe SSDs and VCs" - further down this page | | |

| ... |

|

|

In April 2008

- Nimbus announced an

SSD accelerator option in

its Breeze H-series 10GbE IP Storage (SSD ASAP). A system with

34TB of storage, and 64GB of mirrored SSD costs about $120,000.

Nimbus

carries on the torch of a network storage operating system - which under the

name "Cloudbreak" - was first developed by Nimbus's founder at

TrueSAN Networks

.

That's the kind of groundwork thinking you need to make an

SSD accelerated storage system work economically as part of a

hybrid HDD-SSD

array - while avoiding high manual setup, tuning and configuration costs.

In January

2009 - Nimbus launched its

DH200 - a 4

port 10GbE NAS - which supports upto 10TB of flash SSD storage. See also:-

rackmount SSDs.

In

April 2010

- Nimbus Data

Systems

launched

its S-class

storage system - a 2U 10GbE rackmount SSD with 24 hot swappable

internal 6Gbps SAS

flash SSD blades in an 80W power footprint offering 5TB protected capacity for

$39,995. Powered by Nimbus' HALO storage OS the systems support

iSCSI, NFS, and CIFS

protocols and provide inline

deduplication

(typically 10 to 1), continuous local and remote replication capability

in-the-box at no additional cost. Data protection inside the box ensures that no

data is lost even with 2 simultaneous blade faults. ...read my discussion

with Nimbus's CEO

InJuly 2010 -

Nimbus Data Systems-

announced

higher

density in its 10 GbE rackmount SSD systems - 10TB (enterprise MLC)

in 2U - implemented as 24 x 400GB hot-swappable

SAS flash blades. The

company also announced improved connectivity - upto 120Gbps - from its internal

12 port FlexConnect 'virtual switch' which makes all storage available to all

ports without the need to create and assign volumes to specific ports. Pricing

for a 10TB system with FlexConnect is just under $110k.

In February 2011

-

Nimbus Data Systems

announced that it

achieved

profitability in its fiscal year ending December 31, 2010.

"Today's

announcement of achieving profitability marks Nimbus' maturity from an

innovative startup to an established storage player intent on achieving rapid

market expansion, unmatched innovation, and leadership in the emerging

sustainable storage and flash memory storage market," stated Thomas Isakovich,

CEO and founder of Nimbus. "Our commitment to customer satisfaction and

responsible growth reflects in this important company milestone."

In

August 2011

- Nimbus Data Systems

announced that eBay has deployed more than 100 terabytes of Nimbus S-Class flash

memory to power its VMware virtual server infrastructure. The Nimbus solution

delivered near line-rate 10 Gbps iSCSI performance to the VMware hosts while

consuming 78% less energy and 50% less rackspace than

conventional disk-based

solutions.

Nimbus also announced added

InfiniBand and

FC SAN support to its

pre-existing interface options.

In October 2011 -

Nimbus entered StorageSearch.com's quarterly list of the

top 20 SSD companies

for the first time - coming in at #16 for Q3 2011.

In January 2012 -

Nimbus

announced

its entry into the

high availability

enterprise SSD market with the uveiling of the company's -

E-Class systems -

which are 2U rackmount SSDs with 10TB

eMLC per U of

usable capacity and no single point of failure. Interface support includes

unified 10GbE,

FC, and

Infiniband. Pricing

starts at $150K approx for a 10TB dual configuration system.

In March 2013

- Nimbus Data

Systems

announced

new software APIs which support its proprietary

HALO OS based family

of rackmount SSDs

- and report on hundreds of real-time and historical metrics such as:-

flash endurance, capacity utilization, latency, power consumption, deduplication

rates, and overall system health. Another new feature is health monitoring

apps which run on Android / Apple phones and tablets. | |

| . |

|

| . |

| who are

Nimbus's hottest competitors? - are you sure about that... |

Editor:- August 23, 2012 - SSD companies often

misidentify (in my view) who their most serious sustainable competitors really

are - as predicted by which

enterprise SSD apps silos

they satisfy best.

I was discussing this recently with Thomas Isakovich,

CEO of Nimbus Data

Systems and Scott Kline ,

Director of Corporate Communications as they were getting ready to

launch a

new fast SSD rackmount system (which they earlier this week.)

What I

was most interested in - was the companies they had named as key competitors.

For

the record - Nimbus's list included:-

Violin Memory,

Texas Memory Systems,

Pure Storage and

SolidFire. And the

idea behind the document was to suggest that the new system from Nimbus (called

the Gemini ) is at

least as good or better than the competition - based on what was being compared.

It

was clear to me that a lot of effort had gone into preparing their briefing

document - showing things like comparative capacity per U, price per TB, IOPS,

latency and that sort of thing. And I told them I enjoy reading these things -

because they are the closest I get to reading SSD articles (or joined up writing

about the SSD market) which someone else has written.

I said - "There

are 2 companies in there which I wouldn't have had on the list at all - and at

least one other that I would have added instead.

Now I knew I had

their attention. I always try to divert from any preordained script about the

SSD market - because that's what makes these conversations interesting.

"And

how did you decide which competitors to put on the list?" - I asked.

"We

put companies on this list based on those mentioned as competitors by customers"

they said.

"Well" I said "that explains it. Most

end-users often aren't clear enough in their own undertanding of what they need

- and many SSD vendors aren't focused enough yet to know which business they

should go for and which they shouldn't waste time on. But just because you butt

up against a bunch of companies doesn't mean to say they are your most serious

long term competitors."

"Who would you take out of the list?"

Tom asked "and why?"

I said

Pure Storage -

because they aren't in the same performance class as you (Pure is fast-enough -

whereas Nimbus is fast). And I'd have left SolidFire out of the comparison table

too.

Another - even better reason not to have them in your comparison

list - I said - is that Nimbus has from time to time appeared in the

Top SSD companies list

- whereas Pure Storage and SolidFire haven't. It's less important to worry

about competitors with much lower ratings and concentrate on what you can do

about competitors who are already scoring better than you in the minds of the

market.

Obviously Nimbus wasn't going to argue with me about that

angle.

"OK" Tom said - "who would you put in the list

instead?"

"Fusion-io" - I

said. "Because their new ION

software is a significant product capability which intersects with the set

of paramaters you've shown in your competitive rankings. The cost and

performance of FIO ION based systems will be an important factor in the fast

rackmount SSD market."

My thinking about this is that while it's

unlikely that many end users would realistically look at an SSD rack from

Nimbus and Fusion-io based technology as viable suppliers for exactly the same

application slot - there would be a small number of high volume end users who

would be perfectly happy with the ION based solution and would wrap their own

cloud-like fault tolerant wrappers around it - if they thought it would give

them a significant cost saving compared to the built in HA/FT in the Nimbus

product.

And because Fusion-io may already be in use in servers within

a customer site - that meant that a starting point for competitive comparisons

in rack based SSDs would often be FIO based - even if it wasn't an exact

functional fit.

Nimbus said they have supplied their rack SSDs into

customers who were using Fusion-io cards in servers.

I said

I wasn't surprised

because there are some apps where that would be the best thing for the customer

to do. (I'll be returning to the subject of boundary conditions in the

enterprise SSD market in my September blog.)

Another thing I asked

Nimbus was - do they support

adaptive DSP?

Nimbus said no.

I said - that's another thing which is going

to impact the cost per

TB in enterprise SSD racks - so I didn't think that the cost leadership they

were showing in their tables would last for long. (That was before the recent

launch by Skyera BTW

- which is another company to add to the compete-with list.)

OK - so

apart from chatting about the SSD market - what did I learn about Nimbus's new

SSD?

As I said to Tom and Scott - what's interesting is that if you

assemble a list of leading competitively priced fast SSD racks - then you

can get very similar performance, pricing and capacity density from systems

which have very different internal architectures.

- proprietary:- TMS, Violin

- open (array of PCIe SSDs) - Fusion-io

- open (array of SAS SSDs) - Nimbus

Customers with different risk

profiles (roadmap

symmetry) and prefences about the granularity of how they replace SSDs (is

it the module or rack level? - it's less risky pulling out 2.5" SSDs than

conventional PCIe SSD cards for example) will lean towards one type of supplier

rather than another.

For the same reason - most enterprise SSD users

will wait several quarters to see how reliable Skyera's new systems are in

somebody else's environment rather than risk being early adopters - even

Skyera does have the lowest price in the industry.

3 factors in the

Nimbus racks which I should mention here - and which I haven't written about

before are:-

- internally the array has point to point connections to every SAS drive.

That's a factor in throughput performance and latency.

- the Nimbus product allows non-disruptive software updates.

- Nimbus use high level software in their OS as part of the endurance

management. Overall their rack supports 50x full capacity writes each day for 5

years. (That's a good figure which compares with adaptive DSP - although Nimbus

is doing this a different way using

RAM cache in

each of their flash SSDs.)

| | |

| . |

new thinking in

rackmount SSDs

what do

enterprise SSD users want?

Ratios of SSD capacity -

server vs SAN

The

big market impact of SSD dark matter

Can you tell me the best

way to SSD Street?

|

. |

| another

conversation with Nimbus - PCIe SSDs and VCs |

Editor:- February 2, 2012 - I had an interesting

discussion yesterday with Thomas Isakovich,

CEO and founder of Nimbus

which recently launched its first high availability SAN SSDs.

To be

sure - HA

enterprise SSDs is an "up-for-grabs" SSD growth segment so that

is interesting in itself - but I told Nimbus's Marcomms Director, Scott Kline -

in advance of the call that I would be much more interested in having a

general update about how Nimbus sees itself in the SSD market - than simply

having a CEO voice-over of their new SSD rack's bullet points -

particularly as Nimbus said it was profitable (unlike some other well known

enterprise SSD companies).

a long view

In the minutes

leading up to my call with Tom Isakovich yesterday I looked up his email

address (which I always do just in case the phone fails to connect) and I

reread some earlier exchanges we had going all the way back to when he

was in his previous

company in 1999.

It got me thinking - this is someone who

takes a long term view of where enterprise storage is going. It occurred to me

that if I were to publish some of Tom's views and predictions from more than a

decade ago - they would still stand the test of time as sound bites today.

a

profitable enterprise SSD company

Tom told me Nimbus is

profitable and debt free. As a private company they don't disclose revenue. But

revenue last year was 5x the year before.

VCs IPOs and

acquisitions

Tom said because they don't have

VCs involved they have

more freedom to pursue product development and business development strategies.

Currently that would be via organic growth. So it looks to me that unlike VC

backed loss making SSD competitors - they don't need to steer in the IPO or

wannabe acquired lane.

SAS SSD arrays latency vs PCIe SSDs

I

aked if they had any plans to support

PCIe SSDs (or

2.5" PCIe SSDs)

with their virtualization software - because I guessed they could do it - if

they saw a market opportunity for it.

Tom said - no. Nimbus is

sticking with network storage boxes based around removable SAS SSDs. He could

see no advantages for them to start integrating PCIe SSDs.

When I asked

about latency - Tom said that in one customer evaluation - a Nimbus system

with an Infiniband connection delivered better latency than a PCIe SSD

competitor with an IB router. So in the rackmount SAN SSD space where Nimbus

was focused - PCIe SSDs didn't offer anything for him that he couldn't do with

SAS.

Inside server racks - he agreed - users would use a lot of PCIe

SSDs - just as HDD SANs didn't replace the need for server DAS.

where

is the core of Nimbus's SSD IP?

As I expected - Tom said - it's

mostly in their software - which can manage half a petabyte of SSD in a single

unified file system.

I knew from earlier conversations that Nimbus

design their own SAS SSD modules - but I wasn't sure - apart from cost

advantages and lowering the risk of

firmware shocks -

just how important their hardware IP was. Tom said that their earlier

non-blocking mid plane technology was a factor in performance - but their

new seamless HA failover architecture couldn't be done so well with commercial

off the shelf (COTS) SSDs.

watts and Petabyte SSDs

Tom

said that big data SSD enterprise customers (like eBay - which uses Nimbus SSDs)

look beyond price/performance to assess running costs and density - and he

said he thought that Nimbus's SSDs (TB /U and W/TB) are leading the market

in those respects.

I said that competitors like

Texas Memory Systems

and Violin - would be

sure to disagree on many of the "best" claims in their press release

documents but Tom said that for many users Nimbus's HALO software would be

the deciding factor.

I ended by saying that in 2012 - enterprise

SSD makers with reliable market proven products - would see customer demand

growing on a scale they had never seen before - and as my stats tell me that

many of you readers are interested in learning more about Nimbus - I'll be

updating my profile for them more often.

See later:- what did happen in

2012? - key SSD market transitions, followed by

2013

SSD market changes | | |

| . |

|

|

| . |

|

| |

..... |

| More interesting for me

was the "aha! moment"- when it became clear that it was indeed Nimbus

whose SSD controllers were at the heart of 2 recent high capacity SAS SSD

products from Viking and SMART Modular. |

| Nimbus enters SAS

SSD controller market (August 2017) | | |

| .. |

|

| .. |

| Nimbus

awarded patent for non blocking technology |

Editor:- December 21, 2016 - Nimbus Data Systems

today

announced

it has been granted a patent -

9,268,501 - for the

non-blocking data fabric architecture which is used in its

petabyte scale SSD

racks.

"Conventional

HDD-centric

architectures employed by the majority of all-flash array vendors trap flash

performance behind legacy shared bus and scale-up designs," said Thomas Isakovich,

CEO and Founder. "Now patented, Nimbus Data's Parallel Memory Architecture

overcomes the limitations of generic off-the-shelf servers, capturing the full

performance potential of all-flash technology."

Editor's

comments:- Nimbus's patent relates to a non blocking

SAS-aware fabric

technology.

Other notable SSD box makers which have gone on the

record to talk about their non blocking matrix switch arrangements to reduce

latency and improved throughput include

Texas Memory

Systems (now IBM's flashsystem) and

Violin Memory (VXM). | | |

| ... |

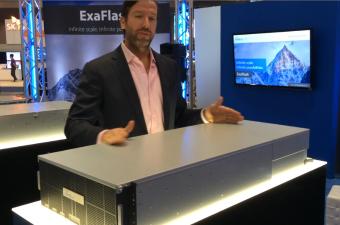

| Nimbus

re-emerges from stealth with 1PB / U raw HA SSD |

Editor:- August 9, 2016 - Nimbus Data Systems has

emerged from its self imposed exit into

marcomms stealth

mode with the

announcement

of a new range of Ethernet/FC/Infiniband attached rackmount SSDs based

on its new

ExaFlash

OS with GA in Q4 2016.

Entry level products start in a 2U box with

50TB raw capacity for under $50K and for larger configurations Nimbus says its

ExaFlash offers an effective price point as low as

$0.19 per

effective gigabyte (including all software and hardware).

Higher

density boxes in this product line - D-series models - will have 4.5 PB raw

capacity in 4U (12 PB effective).

Re the

architecture

- I haven't seen details - Nimbus says there is no data network between the

storage arrays themselves, guaranteeing that performance truly scales in

lock-step with capacity and with consistent latency.

video above shows the 4PB raw ExaFlash

at FMS

Editor's comments:- if there are to be sustainable

roles in the future

consolidated

enterprise SSD systems market for AFA vendors which previously sold arrays

of SAS/SATA SSDs - and who don't own their own semiconductor fabs - the only

viable ways to establish such platform brand identities are with SSD

software and architecture.

There's a huge gap between the technological

aspiration which Nimbus talks about and the weakness of its past marketing and

the kind of

funding which we've

seen competitors in this market burn through in the past with mixed results.

In the next few quarters I hope we'll hear more from Nimbus about its

business development plans and customer adoption.

See also:-

roadmap to the

Petabyte SSD,

the unreal

positioning of many flash array "startups" | | |

| .. |

|

|

| .. |

| Pure Storage's funding

coffers fattened up to nearly $0.5 billion |

Editor:- April 23, 2014 - Pure Storage

today

announced

it had raised another $225 million in funding - bringing the total in all

rounds to $470 million.

Editor's comments:- One of Pure

Storage's many competitors - Nimbus

- whose CEO has taken a different approach to funding (so far) - this week

published an unflattering

side by side features comparison between the 2 company's flagship rackmount

SSDs. | | |

| .. |

| Among the SSD vendors

listed in DCIG's report - the happiest will be Nimbus (who have been crowing

today about being #1). |

Editor:- March 31, 2014 - If you're interested

in

rackmount SSDs

then DCIG has published the

DCIG

2014-15 Flash Memory Storage Array Buyer's Guide (free sign-up page) -

which provides detailed comments on the strengths and weaknesses of rackmount

SSD systems from 20 different vendors - which are currently available in the

market today (includes list prices).

DCIG have created their own

multi-dimensional scoring system in which they look at component features such

as density (TB/U), software compatibility (for example ease of integration with

VMware), and management functions (dedupe, tiering, snapshots etc). DCIG has

ranked these systems overall - and compared many of them to others in the same

price band. Another useful feature of the report is a background story about the

design heritage or market history of each product.

Editor's

comments:- I've read the report and think it's a good read with respect to

the raw data and detailed observations about many of the systems listed.

As

to the product rankings?

I think whether you agree or not -

depends on whether you would assign the same weights to each constituent in the

confidential matrix of factors which DCIG have devised.

For some

users it will reflect your own priorities - for others - the scoring outcome

would be entirely different.

Among the SSD vendors listed in the

report - the happiest will be

Nimbus (who have been

crowing today

about being #1) - and happy too should be

HP (which is #2).

Some

vendors - whose products are best in class in a particular dimension - don't

score highly in the main list because they lose out on the "sum of all

things which DCIG think you might need" - which is an

application dependent

judgement - rather than being a universal "goodness" attribute.

The

only company which is conspicuously absent from DCIG's list (at any rank)

is

Fusion-io. Does DCIG

know something we don't? That's very odd. Related articles:-

| | |

| .. |

|

|

| .. |

| Nimbus IPO date? - this

may be the leading indicator to watch out for |

Editor:- October 1, 2013 - I was talking recently

to Tom

Isakovich, CEO and founder of Nimbus Data Systems...

I asked Tom if he thought the air of uncertainty hanging around

competitors in the

SSD systems market

was affecting the competitive situation for his own company. In particular

I raised the subject of Whiptail's

announced acquisition by Cisco

(would the products still be available? or would some get dropped - like when

IBM acquired

TMS). The ticker ride

for VMEM was still a week into the future when we spoke but anyone who had

read Violin's IPO

disclosures could see their predicament.

He said Nimbus rarely

encounters those other SSD companies as competitors in customer sites - so he

didn't expect to see any short term impact either way. Tom views his real

competitors as being the big traditional storage companies and so when Nimbus

gets an order from a customer who has been using big name storage - he regards

that as being far more significant than beating another SSD systems "startup"

- because Nimbus is competing against prevailing customer inertia.

He

also said that apart from any technical differences between Nimbus and Violin

(he thinks Nimbus's software stack is better) - the other difference is that

Violin hasn't been profitable and its revenue growth rate has been

unreliable.

In contrast to many other SSD companies at the present time

- he said:-

- Nimbus is profitable,

- their sales have tripled this year and

- he expects sales to triple again next year

Being funded by

customers - like a traditional business - means there's no urgency to rush to an

IPO. Tom said the likeliest date he could envisage for an IPO would be

towards the end of 2014.

We moved onto the subject of

why enterprise

customers buy SSD arrays - and we traded stories about some of the

explanations which get tossed around like

IOPS per dollar -

which when you scrutinize them in any detail are ridiculous. We've both seen

leading edge silicon SSD companies put nonsensical graphs into their marketing

presentations which don't lead you anywhere useful in the real world if you

follow the superficial analysis. (That's because these vendors don't make

systems - and are many steps removed from genuine enterprise thinking.)

Tom

said most of his customers couldn't tell you how many

IOPS their

apps were demanding.

I said I've been writing about the "cost

of satisfying a given number of virtual users for a particular type of app"

as being a useful comparison figure (for storage). We both agreed that even if

enterprises don't know for sure what their throughputs or IOPS are - they have a

good idea of how many users they're trying to serve within their organization or

at customer facing web interfaces. The payroll tells you one, the marketing

people can tell you the other. And accounting can tell you how much it all

costs. You don't need storage

analyzer tools to get a feeling for where the ground level lies.

After

we had been talking for about 40 minutes I said - what was it you originally

wanted to talk to me about? - because I knew this conversation had been set up

to coincide with some sort of announcement - but I hadn't seen any details yet.

Tom said he knows that after talking to me for over 10 years I rarely look at

any briefing documents in advance and when I do I never stick to any planned

presentation agenda - so he hadn't sent me anything.

But as our

conversation had already veered towards the subject of a simple way that users

can compare the costs of SSD storage for particular types of apps - and as I'd

asked the question - he said there was a benchmark called IOmark-VDI which

Nimbus had participated in recently with the

Evaluator Group.

He said he went into the process because he thought it might be a good thing to

try out - and was gratified to found out that it shows the Nimbus product in a

very good light with a

cost

under $40 per virtual desktop (pdf) achieved by a 2U Nimbus system

supporting up to 4,032 linked clone VDI images. So that was a good note to end

on.

Now - if any of you have seen

Tom's SSD blogs -

then you'll know that he's been averaging somewhere between one and two a

year. And a few minutes after our conversation had ended - and while

pondering these various matters I thought of a good way to summarize things.

So I sent Tom this email - "when I see you updating your blog

on a weekly basis I'll know that your IPO date is impending." | | |

| . |

| Nimbus brings flash SMART

plus stats to SSD rackmounts |

Editor:- March 25, 2013 - Nimbus Data Systems

today announced

new software APIs which support its proprietary

HALO OS based family

of rackmount SSDs

- and report on hundreds of real-time and historical metrics such as:-

flash endurance, capacity utilization, latency, power consumption, deduplication

rates, and overall system health.

Another new feature is that sys

admins can monitor their

Nimbus SSD arrays

via new apps on Android / Apple phones and tablets.

Thomas Isakovich,

CEO and founder of Nimbus said the new software framework would enable cloud

architects and enterprise customers to gain greater insight into their flash

storage by viewing internal aspects of their flash storage which mattered to

them - rather than simply relying on benchmark indicators which have been

cherry picked by vendors or reviewers | | |

| .. |

|

|

| ..... |

| "Although we can

hearken back to a simpler time when the SSD market was smaller and all the top

players in it were private companies - which in fact isn't that long ago - one

of the new realities of the SSD market is that there's nearly as much interest

in SSDs as $$Ds (lucrative investment vehicles) as in SSDs as business improving

technologies." |

| anticipating -

this week's big story - in SSD news | | |

| ... |

|

|

| ... |

| Nimbus does

that "no spof SSD" thing |

Editor:- January 31, 2012 - Nimbus Data Systems

today

announced

its entry into the

high availability

enterprise SSD market with the uveiling of the company's -

E-Class systems -

which are 2U rackmount SSDs with 10TB

eMLC per U of

usable capacity and no single point of failure. Unified interface

support includes 10GbE,

FC, and

Infiniband.

Nimbus

software (which supports upto 0.5

petabytes in a

single SSD file system) automatically detects controller and path failures,

providing non-disruptive failover. The E-Class also supports online software

updates and online capacity expansion. It has

RAID protection and

hot-swappable flash, power, and cooling modules. Pricing starts at $150K approx

for a 10TB dual configuration system.

Editor's comments:-

Nimbus seemed incredulous at my immediate reaction to the preliminary info they

sent me. I said I knew of competing shipping SSDs which were denser, faster

and offered more HA features too. |

|

But that's not to understate

the value of what the company does. Instead of being impressed by a bunch of

me-too technical metricals I was rather more impressed to learn that Nimbus

is still profitable. | | | |

| . |

| "Suippose you

sell an SSD system to a customer - let's say a low cost

MLC SSD for

video streaming - you can't be sure that later on they might not redeploy that

same system into a different application - with higher write IOPS...." |

| ...why Nimbus prefers eMLC - from

the CEO interview

April 26, 2010. | | |

| . |

|

|

| ... |

|

| . |

| |