|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

rackmount SSDsPCIe SSDshybrid DIMMs memory channel SSDs after AFAs - what's the next box? are we ready for infinitely faster RAM? where are we heading with memory intensive systems and software? storage architectures - from DAS SAN to memory Fabrics and hybrid SSDs |

|||||||

| ... | |||||||

|

... | ||||||

| . | |||||||

|

|||||||

. |

|||||||

|

|||||||

. |

|||||||

|

|||||||

. |

|||||||

|

|||||||

. |

|||||||

|

|||||||

. |

|||||||

|

|||||||

. |

|||||||

|

|||||||

. |

|||||||

| RAM SSDs SSD endurance high availability SSDs the top SSD companies 7 roles for datacenter SSDs roadmap to the Petabyte SSD MLC Flash wars in the enterprise What do enterprise SSD users want? What an Interface Says About an SSD How fast can your SSD run backwards? playing the enterprise SSD box riddle game |

|||||||

. |

|||||||

|

|||||||

..... |

|||||||

|

| |||||||||||

rackmount SSD newsother SSD news / DWPD / SSD cloud / high availability SSDs | |||||||||||

| re IBM's FlashSystem 9100

Editor:- July 18, 2018 - A recent blog - Introducing the FlashSystem 9100 NVMe with FCM - by Barry Whyte at IBM - provided for me - a satisfying sequel and finale to the story of whatever happened to the longest running enterprise SSD accelerator product line in the history of the market - the SAM>RamSan>FlashSystem - which were all fast big shared memory boxes. (The new heir in the family saga - the FlashSystem 9100 is a 2U box with NVMe SSDs inside which provides 403TB usable uncompressed - and GbE, FC or SAS host connectivity.) You can get a taster of the family story in these 2 marker articles - selected from my numerous scribblings.

It's the same kind of horse show (in market role) but with a different technology animal inside and the recent changes in the design architecture today in 2018 are as significant as when TMS redesigned the main memory array in the RamSan product line from RAM to flash in their 2007 model - the RamSan-500. Barry Whyte's new blog says among things:- "The storage development team in Hursley started work on the design of a new generation box back over 3 years ago when I was still based in the UK. The idea was to build a low rack density, and high performance control enclosure that could take NVMe Flash drives, both in terms of NAND Flash based, and look to the future of SCM technologies, such as 3D Xpoint, Z-SSD and whatever else will come along." ...read the blog Editor's comments:- throughout the 30 or so years history of the RamSan and the multi OS supported SAM - Shared Access Memory system which came before and the new FlashSystem (which cane after (and which may have changed its name again depending on when you read this) is the the idea of a product line which evolves to accomodate new memory technologies but retains the legacy purpose of putting data in a box where it can be accessed by many different servers at the lowest practical latency cost. Dell EMC adopts M.2 SSD array concept Editor:- May 17, 2018 - The idea of using M.2 SSDs as the raw flash elements mounted on enterprise PCIe SSD carriers and trays has gaining ground since it was proposed as an evolutionary step by Liqid in January 2016. The M.2 array concept has the performance benefit of proportionality (from NVMe PCIe scalability) coupled with the strategic business merit that M.2 is a competitively priced, high volume form factor which ensures that such modules will be at the forefront of new technology adoption while also including within its ranks good value for money. A recent story - Dell EMC Takes a Stab at 1PB/1U With High Density M.2 Sleds (on StorageReview.com) - shows a picture of a Dell EMC module with upto 10 M.2 SSDs in a single sled. ...read the article Nimbus samples 100TB SAS SSDs Editor:- March 19, 2018 - Nimbus Data Systems has made another significant advance in the development of multipetabyte energy-efficient solid state storage racks with the announcement today that it's sampling 100TB 3.5 SAS SSDs with unlimited DWPD. The ExaDrive DC100 has balanced performance 100K IOPS R/W and up to 500 MBps throughput and consumes 0.1 watts/TB - which Nimbus says is 85% lower than competing drives used in similar array applications - such as the Micron's 7.68TB 5100 SATA SSD. Nimbus says the use cases are:-

ExaDrive technology and reliability? I asked Thomas Isakovich, CEO and founder of Nimbus some questions about the new ExaDrive technology. Editor - The 50TB models announced by your flash partners last year used planar 2D flash. Does the 100TB family use 3D flash? Knowing the answer one way or another will enable some people to make their own judgements about incremental upsides in the next year or so's roadmap. And also form a view about specification stability and reliability. Tom Isakovich - Yes 3D flash for the ExaDrive DC. Editor - The issue of cost per drive is an interesting one too. But the companies you were working with last year have experience in processes which can produce a high confidence reliable SSD for high value, mission critical markets (like military) in which the reliability of every single SSD is critical. So my guess would be that for integrators who have a serious interest in the ExaDrive DC100 – they will be looking at the cost of drive failures on a system population basis – and the value of less drives and less heat per TB is more important than the headline cost of a single failed drive. Tom Isakovich - I have an interesting subject for you to consider on the topic of "reliability". Namely, is an SSD any less reliable than an all-flash array? I contend that it is not. In fact, an SSD is more reliable.

Gen-Z 1.0 now available to view Editor:- February 13, 2018 - The Gen-Z Consortium today announced that the Gen-Z Core Specification 1.0 is publicly available on its website. ts memory media independence and high bandwidth coupled with low latency enables advanced workloads and technologies for end-to-end secure connectivity from node level to rack scale. Editor's comments:- Gen-Z follows in the multidecade footsteps of Infiniband and then recently PCIe memory fabrics - but Gen-Z was born with with confident expectations that because of SCM DIMM wars andthe memoryfication of the enterprise there is a real business potential that memory boxes could become the mainstream instead of sitting in the side lines of HPC. The rev 1.0 specification is a 980 plus page pdf - which I haven't read through yet - but which shows definite promise of a being a thought provoking page turner. From what I've seen so far the thinking looks like a modern, secure and media agnostic way to request or respond to byte and block addressable (or addressed by default as the next component) data packets between a huge scalable population of components which can be memory devices, processors or controllers. Kaminario no longer wants to supply hardware Editor:- January 17, 2018 - 2017 was a difficult year for AFA vendors whose primary IP was software - as they couldn't be sure how much they would have to pay for their memory based hardware and couldn't be sure either if and when they would get it. However, even without the memory shortages it was inevitable that vendors would one day have to align themselves with new trends towards more strongly delineated standard product roles. That day has dawned for Kaminario - which had already churned its hardware deliverables suppliers several times since entering the rackmount SSD market in June 2010. Kaminario today announced it is exiting the hardware market as a supplier and is switching to a software business model. The company's K2 arrays will be supplied in future by Tech Data. Kaminario will continue to provide centralized support management for all datacenter implementations based on Kaminario software. ...Elsewhere:- I commented on linkedin to Eyal David, CTO - Kaminario - who had posted a link to The Register's - coverage of this news - Leading the Software Defined initiative: Kaminario exits the hardware business. I said - "Yup it's the same reason that wordprocessors became floppies on pcs and CAE became tapes for workstations instead of both being boxes. If you can't design hardware and chips then don't expect your customers to keep buying someone else's better box just to get to use your software." ...read The Register article See also:- Kaminario Goes Software-Defined by Chris M Evans on his site - Architecting IT. Chris says among other things... "As NVMe becomes widely available as a storage protocol, NVMe over Fabrics allows high-speed communication between servers, controllers and storage. The logical conclusion is that we will see hardware distil down to racks of enclosures and servers with high-speed networking in between. The Software Defined Data Centre will allow these hardware components to be aggregated into storage arrays, disaggregated solutions or HCI as required." ...read Chris's article AFA market revenue grew to $1.6B in 3Q17 - says Dell'Oro Editor:- December 6, 2017 - "AFA market revenue grew 33% yoy in 3Q17, reaching $1.6 Billion" according to a new report - Storage Systems Quarterly - published by Dell'Oro Group. "All Flash Array is a very important technology segment in external storage. In fact, as a percentage of external storage revenue, it has been growing dramatically—from 22% in 3Q16 to 28% in 3Q17. So every vendor is determined to expand their position in all-flash storage systems" said Jimmy Yu, VP at Dell'Oro Group. Editor's comments:- Dell'Oro's press release lists the 5 biggest vendors and the company can provide more analytical data in their purchaseable reports. more market research stories AccelStor doesn't use capacitor holdup to boost new HA arrays Editor:- November 6, 2017 - The complex interdependencies between capacitor hold up time on RAM flash caches and performance and reliability in SSDs has been discussed many times in StorageSearch.com. In an announcement today about its new 2U flash array for the high availability market - the H510 (pdf) (array of 24 SATA SSDs with 8x 10GbE SFP+ or 4x 16G FC connectivity) - AccelStor said this... "Some vendors adopt NVRAM as a write cache and use supercapacitors to provide energy to write the RAM content into flash in the event of a power failure. However, supercapacitors can still cause a single point of failure. AccelStor aims to provide comprehensive data protection. With the special write-through design, its NeoSapphire AFAs acknowledge the completion of incoming I/O only when 100% of the data has been written on the SSD." AccelStor became known for their high performance arrays for the performance optimized market. The new H510 also includes data security features including cryptographic erase. Many flash arrays includes some kind of performance hit during software upgrades and maintenance. Accelstor says its shared nothing architecture requires no maintenance window. "You can simply perform the maintenance on a single node while receiving the full performance and capabilities of the secondary node." Editor's comments:- I wrote about Accelstor's thinking about the use of NVMs and arrays failover gotchas in an interview article last year. DCIG compares flash arrays from Dell EMC and Pure Storage Editor:- October 18, 2017 - Power consumption and data center footprint are among the key differences noted in a new report - How Dell EMC XtremIO and Pure Storage Flash Arrays Differ - by DCIG. In the introduction DCIG says - "All-flash data centers are coming and with every all-flash array providing higher levels of performance than previous generations of storage arrays, enterprises need to examine key underlying features that go deeper than simply fast they perform. Their underlying architecture, the storage protocols they support, and the software they use to deliver these features are all features that impact how effective and efficient the array will be in your environment." ...read the article see also:- storage market research companies Infinidat secures $95 million C round Editor:- October 3, 2017 - Infinidat today announced it has closed a $95 million Series C financing round. Equity raised by the company to date totals $325 million. Infinidat says that several hundred enterprise customers have adopted its (hybrid storage) InfiniBox platform with more than 2 exabytes of storage deployed globally. Editor's comments:- Although we've become accustomed to storage box makers reporting funding rounds like this and so in that respect this wouldn't attract much comment from me - the interesting thing from an SSD history trends viewpoint is this funding story shows that the hybrid storage appliance model for the enterprise - in which SSDs and HDDs both played a part - is still being regarded by investors as a valid business model. Although the identification of segments in the market which have product gaps still remains - as ever - problematic. The memory shortages of 2017 demonstrated that solid state storage makers couldn't make enough SSDs with their in place production plants to sustain the needs of the SSD market even at inflated prices. CAEN launches high availability 2U FC AFA Editor:- September 15, 2017 - CAEN Engineering today introduced the CAEN CEI-826-FXD - a 2U 10GbE / 16G FC AFA (with 26 native 12Gb SAS bays) for applications such as big data, HPC, Hadoop etc. The CEI-826-FXD's dual-active controller architecture enables both controllers to concurrently provide storage services in real time. Active-Active architecture doubles the available host bandwidth and cache hit ratio, ensuring the greatest utilization of system resources and maximum throughput. If one controller fails, the other controller transparently takes over all storage services. In addition to storage services, management services can transparently pass to the secondary controller. The CAEN array offers high availability with no single point of failure. All critical components are hot pluggable andengineered with full redundancy. Thanks to this robust design, this system can withstand multiple component failures and achieves 99.999% availability. The CAEN CEI-826-FXD solution supports RAID levels 0 ,1 ,0+1 ,3 ,5 ,6 ,10 ,30 ,50, 60, and N-way mirror. Western Digital buys Tegile Editor:- August 29, 2017 - Western Digital announced today that it has agreed to acquire Tegile. The price was not disclosed. Editor's comments:- Tegile was already using a customer of WDC drives (SSDs, HDDs and the InfiniFlash white box SSD array from SanDisk). So Tegile's flexible pricing models for buying storage were already a good showcase for how to integrate these technologies in a user friendly way. One of the business risks of Tegile's business model was that its ideal customers were buying usable storage based on utility model pricing and cost expectations which seemed predictable and scalable upto about the tail end of 2016. Unfortunately those cost predictions have been shattered and ruined by the rising prices of memory and associated shortages in 2017. A few years ago I discussed the risks of the utility model with Tegile - which at that time seemed to be containable technically (because they were obviously related to expectations of reliability, learning from similar customers doing similar things and efficiencies). Tegile's business model meant that external finance could depend on a predictable curve of customer value and cost. When memory prices rise by 50% or more (instead of going down) those curves mean that repeat customer sales can't follow smoothly from what happened before. Who's to blame for the costs? Well the SSD companies which were getting most of the benefit. So that's why I think Tegile couldn't sustain itself as an independent company. For WDC you could interpret this acquisition as a long delayed response similar in thinking to Seagate's acquisition of Dot Hill Systems. Tegile can provide Western Digital with a workable platform and channel to get SSDs and HDDs into the low end enterprise. Analyzing where the costs should fairly be allocated between different business units and comparing those to what the market will tolerate while satisfying ant-trust regulators will fuel some interesting questions for the new owner when it takes hold next week. How much did WD pay for Tegile? Later:- August 30, 2017 - WD Expands its Graveyard with Tegile Acquisition - a blog written by AFA competitor Nimbus - says this... "It's widely known that Tegile was running out of cash. No acquirers showed up as the product is ill-suited for the cloud. Existing VC's saw Tintri's horrific IPO and concluded that unprofitable storage companies are DOA in the public markets. The Tegile deal was a loss for the VC's that pumped $175 million into it (WD being among them). Rather than take the full loss, WD paid well under $100 million to acquire it." WekaIO compares cloud storage pools to IBM FlashSystem Editor:- July 12, 2017 -WekaIO - a cloud storage software company today emerged from stealth and announced details of its cloud-native scalable file system which the company says can deliver performance comparable to rackmount SSDs / AFAs. Editor's comments:- The notable thing for me in this announcement was that WekaIO uses a performance benchmark compared against an IBM FlashSystem 900 (the decendant of the RamSan world's fastest storage systems from TMS.) WekaIO says "Utilizing only 120 cloud compute instances with locally attached storage, WekaIO completed 1,000 simultaneous software builds compared to 240 on IBM's high-end FlashSystem 900. The WekaIO software utilized only 5% of the AWS compute instance resources, leaving 95% available to run customer applications." That's an ambitious positioning statement and offers users a glimpse into the kind of performance they can get by using flash assisted cloud services. Like other modern SSD fabric software software - "WekaIO eliminates bottlenecks and storage silos by aggregating local SSDs inside the servers into one logical pool, which is then presented as a single namespace to the host applications." hard delays from invisibly fixed soft SSD errors can break apps that's why you need better storage analytics - says Enmotus Editor:- June 15, 2017 - Using SSDs as its prime example - but with a warning shot towards the future adoption of NVDIMMs - a new blog - storage analytics impact performance and scaling - by Jim O'Reilly - on the Enmotus blog site - describes how soft errors can contribute to application failure due to unexpected sluggish response times even when the data is automatically repaired by SSD controllers and when the self-aware status of the SSDs is that they are all working exactly as designed. That's the needs analysis argument for storage analytics such as the software from Enmotus which supports the company's FuzeDrive Virtual SSD. Jim says - "Storage analytics gather data on the fly from a wide list of "virtual sensors" and is able to not only build a picture of physical storage devices and connections, but also of the compute instance performances and VLANs in the cluster. This data is continually crunched looking for aberrant behavior." ...read the article Editor's comments:- in my 2012 article - will SSDs end bottlenecks? - I said "Bottlenecks in the pure SSD datacenter will be much more serious than in the HDD world - because responding slowly will be equivalent to transaction failure." And in a 2011 article - the new SSD uncertainty principle - I shared the (new to me) wisdom collected by long term reliability studies of enterprise flash done by STEC - that many flavors of flash controller management contained within them the seeds of performance crashes which would only become apparent after years of use as the data integrity algorithms escalated to progressively more retries and stronger ECC to deliver reliable data from wearing out (but still usable) flash. So I agree with Jim O'Reilly. You do need more sophisticated datasystems analytics then whether or not an SSD has failed. The variable quality of latency can be a source of incredibly long delays in server DRAM too. Micron dares skin in the SSD box game Editor:- May 5, 2017 - Micron this week announced its long overdue plans for entering the rackmount SSD market. Micron's ambitions revolve around SolidScale - a 2U box stuffed with NVMe SSDs and interconnected in a fabric using software from Excelero. Micron is seeking early validation customers and technology partners now and says its platform is expected to begin volume production in early 2018. Editor's comments:- see my article and analysis in SSD news - Micron dares skin in the SSD box game U.S. Department of Veteran's Affairs uses RAID Inc. in 5PB SDS Editor:- December 7, 2016 - A customer news story from RAID Inc. - Department of Veterans Affairs Selects RAID Inc. for Multi-Petabyte Microsoft Storage Spaces Deployment - includes the useful ratio metric that "400TB of flash-accelerated hot tier storage" were used to support 5PB of cold tier data in an InfiniBand attached fault tolerant array which supports over 460,000 devices in more than 280 sites. See also:- "ratio" - mentions in StorageSearch.com Pure says it's ready to ship petabyte SSDs Editor:- October 12, 2016 - Pure Storage today announced availability of its of petabyte-scale rackmount SSD - the FlashArray//m - which in 7U includes 512TB of raw flash delivering 1.5PB of effective capacity (based on its customer use metrics). Re resilience Pure says this product family has 99.9999% availability across the installed base, which equates to only 31.5 seconds of downtime on average per year. Editor's comments:- In my 2013 article - impacts of the enterprise SSD software event horizon - I discussed the improving efficiencies we could still expect to see in pure SSD arrays as more layers of ancient HDD architecture were removed from archeologically stratified software stacks. Pure disclosed in a 2015 white paper - Building HA enterprise flash storage from commodity components (pdf) - that in real-world applications its customer base averaged 5.4x more effective storage than the physical storage in the system excluding gains from thin provisioning. And that provides some context for their effective to raw flash capacity ratio of 3 in the press release - which seems reasonable after you take into account that some raw capacity is "lost" due to reliability strategies. You can also see the signficance of 30 seconds in the above pdf too. You can get a comparitive idea of the elasticity of SSD vendor promises about effective capacity by clicking on the link which mines archived news. See also:- petabyte SSDs Kaminario offers free iPads to boost K2 tryouts Editor:- October 4, 2016 - I saw a promotional email offer from Kaminario today which I think may backfire as it seems to be in direct conflict with the ethical principles of buyers in many large organizations. The promotional email says "Test and evaluate a Kaminario K2 all flash array with up to 50TB capacity for as little as $1.25 per GB and iPAD management console for 45 days. Try it today and the iPad is yours to keep." Editor's comments:- I think the offer will turn off buyers in big companies - because the inducement of a free iPad to take part in the evaluation sounds like a personal gift rather than having any benefit for the evaluating organization. Seems to me that the marketers in Kaminario have been reading too many consumer marketing comics. Violin issues going concern warning Editor:- September 14, 2016 - Violin Memory today filed a FORM 10-Q (pdf) with the SEC which provides a snapshot of the company's poistion for the quarter ended July 31, 2016. Among other things:-

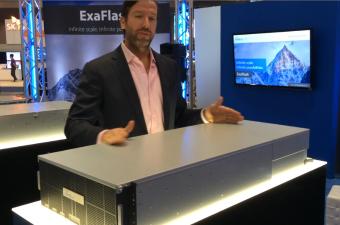

Nimbus re-emerges from stealth with 1PB / U raw HA SSD Editor:- August 9, 2016 - Nimbus Data Systems has emerged from its self imposed exit into marcomms stealth mode with the announcement of a new range of Ethernet/FC/Infiniband attached rackmount SSDs based on its new ExaFlash OS with GA in Q4 2016. Entry level products start in a 2U box with 50TB raw capacity for under $50K and for larger configurations Nimbus says its ExaFlash offers an effective price point as low as $0.19 per effective gigabyte (including all software and hardware). Higher density boxes in this product line - D-series models - will have 4.5 PB raw capacity in 4U (12 PB effective). Re the architecture - I haven't seen details - Nimbus says there is no data network between the storage arrays themselves, guaranteeing that performance truly scales in lock-step with capacity and with consistent latency.  video above shows the 4PB raw ExaFlash at FMS Editor's comments:- if there are to be sustainable roles in the future consolidated enterprise SSD systems market for AFA vendors which previously sold arrays of SAS/SATA SSDs - and who don't own their own semiconductor fabs - the only viable ways to establish such platform brand identities are with SSD software and architecture. There's a huge gap between the technological aspiration which Nimbus talks about and the weakness of its past marketing and the kind of funding which we've seen competitors in this market burn through in the past with mixed results. In the next few quarters I hope we'll hear more from Nimbus about its business development plans and customer adoption. See also:- roadmap to the Petabyte SSD, the unreal positioning of many flash array "startups" Pure Storage says its AFA revenue in Q1 2016 was more than the leading HDD array brand Editor:- June 21, 2016 - Scott Dietzen, CEO - Pure Storage says in his recent blog - Reinforcing a generational shift in data center storage - "...not only were we the fastest-growing storage vendor named in IDC's report, but we cracked of the top 10 storage vendors (for revenue) globally not just for all-flash storage, but for ALL external enterprise storage." Editor's comments:- this result in the real world of market revenue tracking is broadly in line with a long range prediction I made in 2009 - in which I said "50% of the (enterprise) hard disk market will no longer exist in 5 years, and none of it will exist in 10 years (except in museums)." See also:- terabyte talliers and storage market research memory intensive data architecture emerges in a new family of latency roled boxes - unstealthed by Symbolic IO Editor:- May 25, 2016 - 1 petabyte usable storage in 2U along with a flash backed RAM rich server family which uses patented CPU level aware cache-centric data reduction to deliver high compute performance are among the new offerings unveiled today by Symbolic IO which has emerged from stealth mode. Founder & CEO, Symbolic IO - Brian Ignomirello, said - "This industry hasn't really innovated in more than 20 years, even the latest offerings based on flash have limitations that cannot be overcome. Our goal at Symbolic IO was to completely redefine and rethink the way computing architectures work. We've completely changed how binary is handled and reinvented the way it's processed, which goes way beyond the industry's current excitement for hyper-conversion."

Editor's comments:- I hadn't spoken with Symbolic IO (when I wrote this) but my first impression was that the company is in line with at least 3 strategic trends that you've been reading about on StorageSearch.com in recent years:- Their company profile summarizes their capability like this... "Symbolic IO is the first computational defined storage solution solely focused on advanced computational algorithmic compute engine, which materializes and dematerializes data effectively becoming the fastest, most dense, portable and secure, media and hardware agnostic storage solution." For more about the company's background see this article - Symbolic IO Rewrites Rules For Storage on Information Week. From the marketing point of view it's interesting to see that in its launch press release Symbolic IO positions itself in the DIMM Wars context in this way "IRIS... is 10 times faster than 3D XPoint." Symbolic IO says the new systems will be start to become generally available in late Q4 2016. From an enterprise segmentation viewpoint the IRIS systems will be proprietary. There is space for such approaches in the future market consolidation roadmap because not everyone needs the fastest performance. But many webscale SSD companies are already using data reduction techniques for their own utilizations and acceleration purposes. The new thing - if there is a new thing - is that Symbolic IO will make available boxes which incorporate modern data architectures from a single source. Although like all new systems companies they'll have to wade their way through the apps accreditation and compatibility lists before their revenues create any ripples - an adoption dampening factor I wrote about in my 2013 article Scary Skyera. See also:- towards SSD everywhere software Avere ranked #1 in Google's cloud partner search list Editor:- March 16 , 2016 - How well does Avere Systems (and its virtual edge filer) work as a gateway to Google's cloud services? Apparently very well - as Avere today announced it had been named "Google Cloud Platform Technology Partner of the Year" for 2015. Pivot3 acquires NexGen Editor:- January 27, 2016 - NexGen Storage announced today it has agreed to be acquired by Pivot3.

On the other hand we're heard about NexGen many times in recent years. Combining the software and architecture from these 2 companies could produce a platform with characteristics comparable to the best upwardly stretched efforts of much better known competitors if Pivot3 and NexGen can draw the integration boundaries in the right places (and get it done quickly enough). 7 out of top 10 SSD companies are systems companies editor:- January 7, 2016 - Rackmount SSD companies dominated the top 10 zone of the new 34th quarterly edition of the Top SSD Companies published today by StorageSearch.com - with 7 out of the top 10 being in the rackmount SSD business. EMC was the 2nd fastest climber and this period marked Kaminario's best rank in the more than 5 years it has appeared in this series. Looking back at the dominance of rackmount systems makers in past editions in this series - the pattern first became clear in Q2 2013 when it was 8 of the top 10 companies. The compelling technology necessities driving this trend were noted in my 2013 SSD year transitions article. The top level idea is the same today as it was then. "The rack has become the most important form factor at which level enterprise SSD vendors must focus their strategic product ideas. What we're seeing in the market today at the rack level - are efficiencies and competitive advantages which accrue from combining and integrating design factors at many levels within large SSD arrays (at the memory utilization level, the SSD controller level, the drive interface level, the flash array organization level and multiple levels up and down the system software and apps software stacks). Mastering the design possibilities of SSD at the rack level enables new levels of competitive advantages for vendors." It's the precise details which have changed since 2013. Hence all those recent AFA and big data SSD acquisitions. And the market destination has changed too (90% of enterprise vendors will disappear) which means it's less safe for SSD outsiders to sit back and wait to see what happens. Permabit shrinks data in new flash boxes from BiTMICRO Editor:- October 20, 2015 - Permabit today announced that its inline dedupe and compression software is used in BiTMICRO's new rackmount SSD white boxes - which include a 1U iSCSI appliance (20x 2.5" TB SSD shown at FMS) and a 3U fast SSD server (8x PCIe SSDs) which is due to be shipped this quarter. Dell buys EMC - the SSD view good for Dell-EMC - long term good for AFA and hybrid competitors - short term disruption and changes for SSD suppliers - short term Editor:- October 13, 2015 - Dell yesterday announced it has agreed to acquire EMC for approximately $67 billion. The acquisition also included EMC's stake in the storage software company VMware - which will remain in public ownership. Editor's comments:- In the short term this fixes a problem for Dell (its weakness in enterprise storage) and offers a credible way for EMC to adapt to a long term future in which its storage products become more commoditized and accessible to smaller businesses (something which Dell has historically been good at with its server business.) The competitive landscape in enterprise storage is complex but a long term SSD centric summary goes something like this. Servers have become a commodity. And there is little or no scope for genuine competitive value differentation options to be offered within the server market. (Being able to offer the same memories or SSDs in servers as everyone else - does not decommodify server product lines BTW.) In contrast - enterprise storage - which in the HDD and post tape library and post optical storage era (2001 to 2008) had been coasting towards oblivious commoditization - has been temporarily reprieved from that fate (2009 to 2018) by the disruptive impact of SSD memory technologies which enabled the construction of 5 to 6 role differentiated types of new storage boxes which could deliver value to users in ways which were technically unimaginable and unfeasible with classically tiered memory and storage. Having misfired its original entry into the enterprise flash market in 2008 - EMC has in recent years managed to accumulate credible industry leading proprietary IP and product lines in 2 of the 5 above storage box segments (which will satisfy projected enterprise storage needs in the post HDD era) meanwhile treading water in the other 3 main box segments (indicating its aspiration to occupy part of those other crowded beachheads if possible). Assuming all goes well with the acquisition process - the Dell-EMC product line will enable EMC storage to be more competitive in the short term with existing products and to maybe credibly add another notch to the list of product types for which it has aspirations for clear leadership. But the acute efficiency pressures on the server and storage markets which are emerging from SSD centric software and data architectures will mean that traditional product lines from both vendors will shrink away. And those lost revenues will stay gone forever. The old ways and the old purchase orders won't be coming back. That's why it's important for both companies to draw in new smaller customers and to nurture them (if possible) into the new sustainable sold state storage and server product lines. What about impacts for the SSD market? Anyone who competes with Dell or EMC will - for the next year - have an easier ride - due to the inward focus which sucks away the attention of the talent following such acquisitions. The SSD market as a whole will continue to supply memory and SSDs to the new company - and probably can look forward to getting more business in 18 months time. But it won't simply be more of the same. Some SSD vendors may see big changes when Dell EOLs systems and modules which are cannibalistic and compete within the combined product lines. NexentaStor available with InfiniFlash Editor:- September 3, 2015 - Nexenta recently announced support for SanDisk's InfiniFlash AFA box. List price for the integrated solution including, perpetual software licenses, controllers, InfiniFlash, 3 year support and installation can be as low as $1.500/Raw TB. See also:- towards enterprise hardware consolidation, SSD prices "more lanes of SAS than anyone else" - new 4U SavageStor Editor:- July 28, 2015 - As the rackmount SSD market heads towards future consolidation - new business opportunities are being created for those brave hardware companies which accept the challenge of providing simple hardware platforms (which provide high density or efficiency or performance or other combinations of valued technical features optimized for known use cases) while also being willing to sell them unbundled from expensive frivolous software. In that category - Savage IO today launched its SavageStor - a 4U server storage box - which - using a COTS array of hot swappable SAS SSDs - can provide upto 288TB flash capacity with 25GB/s peak internal bandwidth with useful RAS features for embedded systems integrators who need high flash density in an untied / open platform. Savage IO says it "products are intentionally sold software-free, to further eliminate performance drains and costs caused by poor integration, vendor lock-in, rigidly defined management, and unjustifiable licensing schemes." Editor's comments:- I spoke to the company recently and most of you will instantly know if it's the right type of box for you or not. fast rackmount SSDs from EMC, IBM, Pure... which is cheapest? (maybe) Editor:- July 9, 2015 - In a recent blog about the competitiveness of fast rackmount SSDs - Why I Hate Cost/GB Discussions - Michael Martin, FlashSystems Specialist - IBM - leads you through a series of arguments to convince you that - when measured on a 5 year ownership basis (against a very specific set of parameters) his company's fast rackmount SSDs are cheaper to own than competitive models from EMC and Pure. Among other things Michael says - "Why is everyone so focused on the initial cost when it comprises such a small percentage of the "real" or total cost of the storage array?" One interesting boundary condition question which Michael Martin looks at is - what is if EMC gave you a FREE VMAX? How would that compare to the IBM V9000 FlashSystem's TCO? I like that style of analysis - because it's one I've used a lot myself in the past 12 years or so - in various market forecasts where I looked at the cost of one type of product being zero but another type of product (SSD) still being cheaper or better. Editor's comments:- recently we've seen survey data from Tegile suggesting that for a significant proportion of enterprise users the ROI on their enterprise flash investment can be as little as 1 or 2 years - which suggests that looking at the 5 year cost, or the initial purchase cost are equally unreliable expectations. For most users - the uncertainty of capturing reliable predictive cost benefit data to justify the acquisition of enterprise flash arrays was discussed in my article - Exiting the Astrological Age of Enterprise SSD Pricing. The reasons for choosing one system over another include so many user preferences and associated customer service values that the 5 year predicted cost from a particular web site are not likely to be the decisive factor for most users - who will prefer to trust their own analysis. As long as you don't take the rankings in Michael Martin's blog too seriously - as gospel - and don't come away with the idea that IBM's FlashSystem is always the best and cheapest fast rackmount SSD - it's a fun read. ...read the article Conspicuously absent however in this discussion - given the 5 year cost justification timeframe - is a new class of fast rackmount SSDs which will be emerging in the next year - based on arrays of 2.5" NVMe SSDs - which will have the same impact on this segment of the market (IBM, EMC, Violin etc) as did flash on RAM SSDs. (Implode the costs and explode the scalability and market roadmaps.) See also:- SSD costs and justifications 2001 to 2015 SolidFire opens sales channel in Japan Editor:- March 19, 2015 - SolidFire today announced it has expanded its sales reach into Japan with the opening of a new office in Tokyo and a distribution agreement with ITOCHU Techno-Solutions. | |||||||||||

| . | |||||||||||

| |||||||||||

| . | |||||||||||

| |||||

| ... | |||||

| |||||

| ... | |||||

| |||||

... | |||||

| |||||

... | |||||

| |||||

... | |||||

| |||||

..... | |||||

| |||||

..... | |||||

| |||||

..... | |||||

| |||||

..... | |||||

| |||||

..... | |||||

|