| ||||||||||||||||

| ||||||||||||||||

| ||||||||||||||||

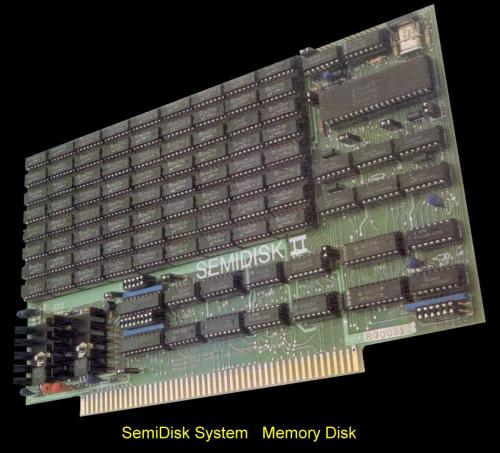

| Coming of Age for SSDs After decades in "virtual stealth mode", and many false starts and setbacks, the SSD market has come out as an exciting technology which will change the way all computers are designed. Although manufacturers in the industrial controls market, like Square D and Allen-Bradley were using rewritable user removable non volatile solid state storage modules as early as the 1970s, it wasn't till much later that the SSD market evolved into a form which we would recognise today. For most of its early life, this technology remained an open secret - mainly used in embedded systems in military applications, or in high performance computer research labs. There were many false starts with Non Volatile semiconductor technologies which didn't survive. In the late 1970s - silicon nitride EAROMs (electrically alterable ROMs) were marketed by General Instruments. They had electrically controlled block erase (like later flash memory). The block erase took 100 milli-seconds using a 42V pulse. Read access time was 2 microseconds which was only 4x slower than other types of MOS memory in those days. Unfortunately field use showed that the extrapolated data life of 10 years wouldn't be achieved in practise. (The erase / write cycle limit - or endurance as we now call it - was later downgraded by the manufacturer to 1,000 cycles per cell - for 10 years retention - compared to a much higher figure in the preliminary datasheets.) As a result many industrial companies like the company I worked for in 1980 stopped using EAROM and switched to battery backed CMOS RAM instead. 1976 - Dataram sold an SSD called BULK CORE which attached to minicomputers from Modular Computer Systems and emulated hard disks made by DEC and Data General. Each chassis held 8x 256k x 18 RAM modules and had a capacity of 2 megabytes. 1977 - Micro Memory launched the MM-S100 - a non volatile RAM card for the Altair (S-100) bus which provided 8KB storage and cost $650. It used magnetic core store but included all the interfaces needed to provide compatibility with Intel's 8080 microprocessor. Strictly speaking (despite having no moving parts) the MM-S100 wasn't an SSD (definition) - because the memory wasn't implemented by semiconductors. In 1978 - StorageTek launched the STC 4305 - an SSD aimed at the IBM mainframe plug compatible market. The STC 4305 was 7x faster than IBM's 2305 HDD system (and also about half the price) and StorageTek's SSD - which was implemented by a "cabinet full" of charge coupled devices (pdf) - cost $400,000 for 45MB capacity with throughput speeds upto 1.5 MB/s. Fred Moore, who was Manager, WW Systems Engineering for StorageTek at the time told me (in 2016 for this article) - "The original STK 4305 was built using CCD. We built less than 25 CCD units before shifting to DRAM. I believe CCD supplier issues were a key factor for the change. As soon as that change was made, efforts to add battery backup options gained momentum." Also in 1978 - Texas Memory Systems introduced a 16 kilobyte RAM-based solid state disk system designed to accelerate field seismic data acquisition for oil companies. 1980 - Dataram marketed an updated version of their BULK CORE SSD for use with DEC PDP-11 and Data General minis. In the early 1980s - Intel's 1M bit bubble memory created a lot excitement as a new non volatile solid state memory technology. Intel shipped design kits and boards to developers using this technology - which was positioned as a solid state floppy disk. But it failed to be scalable or cost effective. Intel spun off the magnetic division in 1987 to Memtech (who later made flash SSDs) but bubble memory dropped into oblivion. In 1982 - SemiDisk Systems (based in Beaverton Oregon) became the first company to ship SSD accelerators for the Intel microprocessor based PC market. SemiDisk's first disk emulator cards were S-100 form factor RAM SSDs with 512 kilobytes capacity ($1,995 price at launch). Internally they used 64Kb DRAM, worked via a proprietary interface - and were designed to work with S-100 computers (which had Z80 8 bit CPUs inside with a 64 kilobytes addressible bus). Soon after, SemiDisk built similar cards for TRS-80 Model II computers, and IBM PC's, and Epson QX-10 computers, and increased the capacity to 2 megabytes when 256Kb DRAM became available. 1985 - Curtis introduced the ROMDISK SSD for the IBM PC. In 1987 EMC introduced SSD storage for the mini-computer market, which was the hottest part of the server market at that time. EMC's SSDs were 20x faster than the then available hard disks. But market forces and losses led to EMC exiting the "memory enhancement" business soon after. 1988 - SanDisk founded. 1989 - Adtron developed its first memory card drive for the proprietary memory cards manufactured by Epson and Mitsubishi. These 1st generation memory card drives found applications with companies such as GRiD, HP, and Trimble Navigation. In 1990 - NEC marketed 5.25" SCSI SSDs using internal battery backed RAM. (Editor's note - I benchmarked this SSD on a Sun SPARCengine blade for a real-time embedded defense app using Oracle. But it wasn't fast enough for what my customer had in mind.) In 1991 Digital Equipment Corp marketed the EZ5x family of Solid State Disk accelerators for use with its Vax servers. SunDisk (later SanDisk) shipped the world's first 2.5" flash SSD to IBM. The 20MB drive oem price was $1,000 ($50K / GB). In 1993 - Solid Data Systems was founded. The company soon after patented technology for Direct AddressingTM - which maximized SSD performance by translating SCSI addresses directly into DRAM eliminating intermediate delays. StorageTek acquired Amperif which had been selling a RAM SSD product called Arctic Fox. In 1994 - The SPARC Product Directory listed 2 SSD products aimed at the Sun server market.

In 1996 - ATTO Technology marketed the SiliconDisk II. It was a 5.25" form factor SCSI-3 interface RAM SSD with 64MB to 1.6GB capacity. Throughput was 80MB/s, and performance was 22,000 IOPS. 1997 - in the SSD market A white paper by Peripheral Concepts listed the main SSD vendors as:- Quantum, Imperial Technology, SEEK Systems, and Solid Data Systems. Bridgeworks designed a RAM SSD with hard drive backup. Sales Director - David Trossell told me - "It was a little ahead of its time and the company dropped it after poor sales." Altec ComputerSysteme marketed a range of SSD modules which converted flash memory cards into parallel SCSI flash SSDs.  In

1998 - STORAGEsearch.com published a daily updated

online directory of solid state

disk vendors - in which Megabyte

was shown chipping away at a rock - which remains the current site metaphor

used for general SSDs. In

1998 - STORAGEsearch.com published a daily updated

online directory of solid state

disk vendors - in which Megabyte

was shown chipping away at a rock - which remains the current site metaphor

used for general SSDs.In 1999 - BiTMICRO launched an 18GB 3.5" flash SSD. In November 1999 - the number of market active SSD manufacturers listed on STORAGEsearch.com had reached 11 companies. | ||||||||||||||||

|

| ||||||||||||||||

2000 - world's first online ads for SSDsIn January 2000 - after 8 years featuring editorial about SSDs in our various publications, Curtis became our first SSD advertiser. (By 2011 100% of our publishing company's revenue came from SSD ads - as we stopped accepting ads for any other types of storage products.)In February 2000 - BiTMICRO unveiled the E-Disk ATE35 - the world's fastest 3.5" PATA SSD with 200µS average access time, 11MB/s burst R/W transfer rates, and 9MB/s sustained R/W. Capacity options ranged upto 19GB. In July 2000 - SST (Silicon Storage Technology) entered the embedded mass data storage market with the introduction of a flash memory-based ATA-Disk Chip (ADC) product family packaged in a 32-pin DIP package and are available in a range of capacities upto 64 MByte. SST's ADC used a standard ATA/IDE protocol and could be used as a replacement for conventional IDE hard disk drives. In September 2000 - VMIC embedded M-Systems' Diskonchip SSD into Linux single board computers. In November 2000 - Solid Data Systems published an article - Solid State File-Caching for Performance and Scalability - which discussed the declining performance (versus capacity) in new generations of hard drives - and showed how SSDs could boost the performance of legacy servers and RAID systems by x4. Also in November 2000 - BiTMICRO launched the world's 1st hot-swappable 3.5" SCSI SSD. 2001 - fast FC SAN SSDs offer 32GB and 100K IOPS in 2UIn January 2001 - M-Systems sampled the world's smallest 16MB single-chip flash disk, the DiskOnChip 2000 TSOP.In May 2001 - Winchester Systems introduced a product called - FlashSSD - as an option in its OpenRAID enterprise storage SAN products. This non-volatile solid-state disk was for the typical 1% to 5% of an application's "hot files" that account for 50% or more of all disk requests. FlashSSD delivered a sustained and constant 12,000 IOPS and 40MB/s data throughput. The company said - this data rate is consistent for all types of I/O including all reads and writes, all sequential and random transactions and for all large and small block transfers. It could speed up disk based applications by 2x to 5x. In June 2001 - Adtron shipped the world's highest capacity 3.5" flash SSD. The S35PC had 14 gigabytes capacity and cost $42,000. In July 2001 - Cenatek entered the SSD market with the launch of its Rocket Drive - a PCI bus RAM SSD which was designed as a performance accelerator "delivering performance of up to one million transactions per second." The product's designer Jason Caulkins - went on later to become the CTO of Dataram's SSD business. In Q1 2001 - SSDs were the 18th most popular subject with our readers. In October 2001 - the number of market active SSD manufacturers listed on STORAGEsearch.com had reached 21. Texas Memory Systems began running ads on StorageSearch.com to promote its RamSan-210 - which was a 2U RAM SSD - with 32GB capacity, 4x FC ports, 100,000 IOPS and 20 microseconds access times. Also in October 2001 - Adtron - with revenue of $25 million in 2000 - was named in the Inc 500 list of fastest-growing private companies. In December 2001 - Platypus Technology announced a channel strategy for its high-performance RAM SSD accelerator systems to "free applications from the I/O bottlenecks caused by hard drive-based storage, allowing mission critical files to run from silicon, rather than from rotating platters." 2002 - 1st NAS flash SSDIn Q1 2002 - SSDs was the 4th most popular subject with our readers.In August 2002 - M-Systems and Toshiba announced a collaboration to market a 16MB version of M-Systems' DiskOnChip MLC flash SSD (which later grew to 2GB capacity in 2004.) | ||||||||||||||||

| ||||||||||||||||

| In October 2002 -

BiTMICRO set a new

density record with a 77GB dual ported fibre-channel 3.5" flash SSD. Also in October 2002 - M-Systems launched a patent suit against a company called JMTek LLC - for infringing patents on USB flash drive technology. Also in October 2002 - Michael Hajeck, Dave Merry and John Conklin co-founded SiliconSystems. | ||||||||||||||||

| ||||||||||||||||

|

| ||||||||||||||||

2003 - terabyte SSDs become commercially availableWith the benefit of hindsight it can now be clearly seen that 2003 marked the beginning of the Modern Era in the SSD market (after which date - the only serious technology which could displace an SSD from its market role was another SSD or SSD related technology).In February 2003 - Competitors Texas Memory Systems and Imperial Technology announced the world's first terabyte class SSD systems. The Tera-RamSan, from TMS, provided 2 million IOPS, a 1024 gigabyte capacity, and 128 2-Gbit Fibre Channel links. It required 2 racks and 5000 watts. The MegaRam-10000, from Imperial, cost $2 million for a 1TB subsystem with 48 fibre channel ports. In Q1 2003 - SSDs were 2nd most popular subject with our readers.. In May 2003 - Imperial Technology launched the WhatsHot SSD analysis tool. In July 2003 StorageSearch.com announced that "the Solid State Disks (SSD) page was the number #1 product category out of more than 60 storage focused directories visited by StorageSearch.com readers in the quarter ending June 30, 2003" That's why we researched and compiled the world's first annual Solid State Disks Buyers Guide in July 2003 which collected together in one convenient document pricing information from across the whole SSD industry. It covered the range of budgets from under $50 up to $2 million and everything in between. Also in In July 2003 - BiTMICRO announced the availability of the E-Disk SafeCapacity software suite - which identified "hot" files as candidates for migration to the fast tier of solid state storage. In August 2003 - Ramtron began sampling the first FRAM (ferroelectric random access memory) built using 350nm design rules. The FM25CL04 was a 4-kilobit SPI interface nonvolatile RAM that ran on 3 volts. It could R/W continuously up to 20 MHz with no write delays and was not restricted by endurance limits. It offered 10 years data retention and was rated over the industrial temperature range of –40 to +85 degrees C. In October 2003 - Memtech announced that its Wolverine - a military 5GB 2.5" 9.5mm high PATA SSD designed for use in submarines, space vehicles and aircraft carriers - was guaranteed to exceed a minimum of 8 million erase/write cycles. In November 2003 - SanDisk was added to the NASDAQ-100 Index of premier, non-financial, growth companies. | ||||||||||||||||

| ||||||||||||||||

|

| ||||||||||||||||

2004 - StorageSearch.com asks - what do SSD buyers want?In 2004 StorageSearch.com conducted the world's 1st survey of SSD Buyer buyer preferences. We also published the 1st SSD Buyers Guide which included prices, and the 1st market model estimating the $10 billion / year potential of the SSD market.In March 2004 - StorageSearch.com reported that SSDs had become the #1 most popular topic with our readers in Q1 2004. At that time there was a 2 to 1 difference in capacity between the highest density 3.5" SSD and HDD drives. In July 2004 - Adtron began shipments of the industry's first SATA flash SSDs aimed at the industrial and defense markets. The A25FB was available with upto 40GB capacity, had 40MB/s sustained R/W speeds, and included fast secure erase. Pricing for the 16GB model was $11,200. In August 2004 - BiTMICRO launched its Ace-Disk 2.5" Series PATA SSDs. These rugged industrial SSDs had burst read/write rates of up to 8.3 MB/sec and sustained R/W rates of 2.5 MB/sec and 1.2 MB/sec, respectively. Capacities ranged from 64 MB to 2 GB of pure solid-state storage. In September 2004 - BiTMICRO announced it was developing iSCSI SSDs. But due to the hyped iSCSI market in 2004 being 10x smaller than analyst predictions - this product was quietly shelved. In October 2004 - Sun Microsystems signed an agreement to resell rackmount SSD accelerators from Texas Memory Systems. In Q3 2004 - a solid state disk manufacturer, Texas Memory Systems, became the #1 company profile viewed by our readers (out of more than 1,000 storage company profiles in September 2004). We also disclosed that the Solid state disks directory (still at #1) got 42% more pageviews than the year ago period. In October 2004 - STORAGEsearch opened the SSD Survey a 3 month major market research study to learn more about SSD buyer preferences, applications and attitudes. Results from the survey were published in articles in 2005 and detailed findings helped SSD vendors understand the needs of buyers better, and helped them develop marketing plans which worked around the prevailing disinhibitors to product take-up and leverage the enablers cited by buyers in the survey. Also in October 2004 - BiTMICRO Networks shipped the world's first Ultra320 SCSI flash solid state disk. In November 2004 - Ramtron announced that its FRAM had been used in an embedded server card aimed at applications like gaming machines which required fast and secure data access and where data integrity is unaffected by power dropouts. | ||||||||||||||||

| ||||||||||||||||

|

| ||||||||||||||||

2005 - Samsung declares SSDs a strategic marketIn January 2005 - STORAGEsearch disclosed results of the SSD Survey to strategic oem customers. The results included buyer preferences for form factor and interface, budgetary data and factors which would make it easier for SSD vendors to do more business in future. Selected extracts from the survey results also appeared in articles and editorial.In March 2005 - SiliconSystems announced that Bell Microproducts would distribute its SSD products in North America. This would greatly simplify the access to this technology for thousands of systems integrators and oems. Also in March 2005 - Curtis (which had shipped over 15,000 RAM SSDs worldwide) revealed that its Nitro SSDs (3.5" FC RAM SSDs) had accelerated the network infrastucture in a major phone provider in China. The customer, the GuangDong Branch of China Mobile was the biggest provincial branch in the Chinese Telecom industry, with over 30 million users. ...read the case study (Word) In March 2005 - 5 out of the top 10 company profiles viewed by STORAGEsearch.com readers in March were SSD Makers (out of more than 1,000 storage company profiles). Site readership grew 6% compared to the year ago period and pageviews grew by 25%. In April 2005 - Texas Memory Systems offered the world's first performance related guarantees for SSD products. That they would outperform any competing storage system, or meet the customer's agreed application speedup expectation - or the customer would get their money back. This approach was founded on market research data from STORAGEsearch.com's Q405 SSD User Survey - which said that users would be more likely to try SSD systems if vendors offered such guarantees. Solid Access Technologies made the first SSD with a Serial Attached SCSI interface. SiliconSystems published (what turned out to be) a classic white paper - Increasing Flash SSD Reliability. In May 2005 - Samsung Electronics announced it was entering the SSD market with 1.8" and 2.5" drives. This is the first time in this phase of the SSD market's development that a multibillion dollar company (Samsung's 2004 revenue was $55.2 billion ) has entered the market. Also in May 2005 - this was the first time that the term "solid state disk" generated enough volume to show up on the top referring searches to this site. Also in May 2005 - M-Systems announced volume shipments of the highest capacity 3.5" SSD. The FFD Ultra320 SCSI - which met MIL-STD-810F and was rated for industrial temperature operation - had upto 176GB SLC capacity (in a 1" high case) and delivered throughput rates upto 320MB/s peak through its parallel SCSI interface. It also supported various fast purge options. In June 2005 - M-Systems announced availability of the industry's highest capacity 2.5" SATA SSD with 128 gigabytes of storage. SATA had been identified in STORAGEsearch.com's Q404 market research survey as the #1 most popular interface for future applications. But at this stage in the market's development (Q205) only 10% of SSD vendors (3) actually offered products with this interface. In July 2005 - Texas Memory Systems launched the industry's first SSDs with a 4Gb/s Fibre Channel interface. The 3U rackmount system offered upto 128-gigabytes capacity and 500,000 random I/Os per second performance. In August 2005 - SimpleTech acquired Memtech. The acquisition of one SSD company by another had (so far) been a rare occurrence but could become more common in future. In September 2005 - SimpleTech launched the world's first dual interface SSD. At launch time the Zeus Dual Interface SSD, with both a USB and SATA interface, offered capacities up to 192GB in a 3.5-inch form factor, and sustained read/write rates of 60 MBytes per second. In October 2005 - Texas Memory Systems and CCP Games revealed that the world's largest game universe was accelerated by a 64GB RamSan SSD. A record breaking 17,000+ concurrent users interacted together within the EVE Online (science fiction) game environment running on 150 IBM servers. The SSD resulted in a 40x improvement in performance. In November 2005 - STORAGEsearch published a new updated market penetration model for the SSD market called - Why are Most Analysts Wrong About Solid State Disks? Also in November 2005 - Texas Memory Systems demonstrated the first solid state disk with a native InfiniBand interface at the Supercomputing conference. Here below is one of the banner ads we were running in November 2005.  In December 2005 - Fusion-io was founded. 2006 - SSD awareness flares into notebook user marketIn January 2006 - NextCom became the first notebook maker to qualify flash SSDs for use in Windows XP, Linux and Solaris notebooks.The drives used were BiTMICRO's E-Disks.Also in January 2006 - SiliconSystems announced a new technology called SiSMART built into the company's entire SiliconDrive product line. By monitoring read/write activity, SiSMART technology enabled designers of SSD systems to collect raw data from which to extrapolate flash wear out effects and predict application specific SSD operating life. In March 2006 - Samsung Electronics started shipping 1.8" 32GB flash SSD drives. Quoting projections from Web-Feet Research, Samsung said it expected that the SSD market would double to $1.3 billion in 2007 and reach $4.5 billion by 2010. Also in March 2006 - the number of market active SSD manufacturers listed on STORAGEsearch.com had reached 36. In April 2006 - Solid Access Technologies became the first SSD manufacturer to display end user pricing online for the full range of its SSD products. Previously the volatile nature of memory pricing and fear of price led competition had meant that most SSD oems declined to publish any pricing data. The SSD pricing exclusion zone included their own websites, press releases related to product launches, and even our own SSD Buyers Guide. In May 2006 - Samsung launched the world's first high volume Windows XP notebook using SSDs. In June 2006 - SiliconSystems launched its SiliconDrive Secure family which included the widest range of available storage security features in a solid state disk. In July 2006 - market research company In-Stat predicted that 50% of mobile computers would use SSDs (instead of hard disks) by 2013. Also in July 2006 - Xiotech announced support for solid state disks as accelerators in its Magnitude 3D 3000 virtual storage systems - making it the first Fibre channel SAN switch maker to support SSD technology. In August 2006 - the number of market active SSD manufacturers listed on STORAGEsearch.com had reached 41. DV Nation became the first US reseller to market SSDs online aimed at consumers and SMBs. In September 2006 - Samsung Electronics announced first working prototypes of PRAM - Phase-change Random Access Memory. This is a new non-volatile RAM technology. Samsung said PRAM is expected to replace high density NOR flash within the next decade Also in September 2006 - the growth of market interest in SSDs was revealed by STORAGEsearch.com's web statistics. Pageviews on our main SSD page increased 50% in September compared to the year before period, even though readership had only grown by 10%. The pageview growth happened despite the fact that the SSD page had slipped down to #3 (out of hundreds of storage categories.) This indicates a concentrated shift by readers towards the hottest subjects that matter most to their future plans. At the same time a greater proportion of the most popular storage articles were about SSDs. Also in September 2006 - Broadbus was acquired by Motorola. In October 2006 - STEC acquired UK SSD maker Gnutek. Gnutek's Maracite - a 3.5" FC flash SSD with R/W IOPS performance of 52K and 18K - provided core founding IP for what later became STEC's most successful enterprise focused SSD product line - the ZeusIOPS. In November 2006 - Microsoft announced business availability of its new Vista operating system - heralded as being the first PC market OS to include SSD-aware support and native SSD cache management. Also in November 2006 - SimpleTech demonstrated the first single chip SSD with USB or IDE interface. The chip is available with upto 4GB capacity. Also in November 2006 - SanDisk acquired M-Systems which had been the fastest growing storage company in 2004 and a a pioneer in the use of MLC in SSDs. In December 2006 - Microsoft published an article:- Windows PC Accelerators - which described in detail how the recently launched Windows Vista OS supports solid state disks. Also in December 2006 - Advanced Media entered the SSD market taking the total number of SSD manufacturers listed on STORAGEsearch.com to 44 - which is 4 times as many as in 1999. SSD Market History - 2007I called 2007 - the "Year of SSD Revolutions".This was the year in which 2.5" and 3.5" flash SSDs from Mtron and Memoright broke away from the me-too performance pack - and showed that single flash SSD drives in traditional HDD form factors could economically challenge the R/W throughput and random IOPs of the fastest enterprise hard drives. Meanwhile rackmount flash SSDs from EasyCo (array of COTS SSDs) and Texas Memory Systems (proprietary flash array) showed that flash SSDs could replace some market niches previously held by RAM SSDs - at much lower cost and without worrying about wear-out. For all SSD milestones in 2007 - click here. Below is just a partial list. In February 2007 - amid competing claims from various other oems Mtron launched the fastest 2.5" PATA SSD - with 80M bytes / sec sustained write time. In March 2007 - SanDisk joined the overheating market for 2.5" SATA SSDs. In April 2007 - Fujitsu announced it had terminated plans to manufacture 1.8" hard drives for portable products - because in this form factor it said SSDs can offer better speed, lower power, lower weight and lower cost. In May 2007 MOSAID Technologies announced its new flash chip technology could deliver 800M bytes / second sustained throughput for flash SSDs using today's technology. In June 2007 - SiliconSystems said that it had received an additional patent for its PowerArmor voltage detection and regulation technology. PowerArmor, used in the company's SiliconDrives protects critical operating system files and application data from corruption due to power disturbances. In August 2007 - Violin Memory launched world's fastest 2U SSD.

In October 2007 - Memoright launched itself on the international SSD market when they demonstrated a range of 2.5" 64GB PATA and SATA flash SSDs which were the fastest in the market at that time - with 100MBytes/sec sustained read and write transfer rates. In November 2007 - Micron Technology said it would launch a family of SATA 1.8" and 2.5" flash SSDs in Q1 2008 bringing the total number of market active SSD oems to 60. In December 2007 - SSD Alliance is founded to develop compatibility standards for flash SSDs. Also in December 2007 - Toshiba said it will enter the SSD market with 1.8" and 2.5" SATA models which will be sampled in January 2008. SSD Market History - 2008Year of the SSD Centurians. This is the year which the number of SSD oems passed 100 companies, and in the server market fast flash SSDs broke the asymmetric R/W IOPS barrier!For all SSD milestones in 2008 - click here. Below is just a partial list. In January 2008 - After a 20 year gap EMC re-entered the SSD market with the launch of its Symmetrix DMX-4 networked storage systems populated with SSDs from STEC. In February 2008 - SMART acquired Adtron for a sum in the region of $20 to $35 million. In March 2008 - OCZ entered the SSD market with a 2.5" flash SSD - taking the number of SSD oems listed on STORAGEsearch.com to 70. In April 2008 - Seagate filed suit against STEC alleging patent infringements related to hard disk interfaces. The case was seen by many SSD proponents as a potentially deadly but seriously misguided missile launched at the entire SSD market. It was later dismissed without merit. In May 2008 - California based SiliconSystems opened its first office in the People's Republic of China. In June 2008 - Fusion-io said it was adapting its flash SSDs (click to see pdf) to provide acceleration in HP's BladeSystem servers. In July 2008 - STORAGEsearch.com published an article - Can you trust flash SSD specs & benchmarks? as a warning to readers about the unreliability of many SSD test results which were being published on the web which we knew weren't set up properly. In August 2008 - Violin Memory said it had delivered 1 million IOPS on a single interface port (a world record) using the latest version of its Violin 1010 memory appliance. Violin also said that its new technology would deliver 100K write IOPS on a future flash SSD version of their product. In September 2008 - Samsung published an open letter aimed at shareholders offering to buy SanDisk in an effort to subvert SanDisk's rejections of its earlier attempts to acquire their company and flash IP. In October 2008 - Intel started shipping the X-25E - a fast 2.5" 32GB SATA SLC flash SSD. Read latency is 75 microseconds and a 10 parallel channel architecture enables it to sustain R/W throughputs of 250 / 170 MB/s. Random IOPS performance is impressive with a 10 to 1 R/W ratio which is inline with the best designed enterprise flash SSDs. Using 4kB blocks - random R/W IOPS are 35,000 and 3,300 respectively. Also in October 2008 IMEC said it had started new research activities on resistive RAM (RRAM) cells. These research activities were focused on non-volatile memory (NVM) technology, concepts and solutions for the 32nm generation and below. At the time RRAM was described by IMEC as a "potential candidate to replace conventional flash memory below the 22nm technology node". In November 2008 - Violin Memory announced availability of a new 1010 Memory Appliance - a fast 4TB SLC flash SSD in a 2U rackmount. Its patent pending non blocking architecture delivers the best ratio of flash R/W IOPS in the industry - over 200K random Read IOPS and 100K random Write IOPS (4K block). Interface options include:- PCIe, Fibre Channel and Ethernet. Also in November 2008 - the world's first online ads for PCIe SSDs started running here on the mouse site. Below you can see the 1st draft "temporary" banner ad which was seen by hundreds of thousands of readers. Fusion continued advertising their PCIe SSDs on StorageSearch.com right up to the time they were acquired 6 years later.  In December 2008 - SiliconSystems published a significant whitepaper - NAND Evolution and its Effects on SSD Useable Life (pdf). Starting with a tour of the state of the art in the flash SSD market the paper introduces several new concepts (including write amplification and wear leveling efficiency) to help systems designers understand why current wear usage models don't give a complete picture. SSD Market History - 2009I explained why I thought 2009 would go down in history as the Year of SSD Market Confusion. This is the year in which search volume for PCIe SSDs surpassed that for any other SSD form factor - knocking 2.5" SSDs off the #1 slot.It was also the year that flash SSDs reached the same storage density as hard drives in the same form factor. For all SSD milestones in 2009 - click here. Below is just a partial list. In January 2009 - pureSilicon said it is sampling the highest density 2.5" SSD - with 1TB capacity in a 9.5mm high form factor. Sustained read / write performance is 240MB/s and 215MB/s respectively. The SATA SSD has latency under 100 µsec and is rated at 50,000 read IOPS, and 10,000 write IOPS. I asked if compression was involved in achieving the capacity - but was told - no. Internally it's got 128 pieces of 64Gb MLC NAND. In February 2009 - Steve Wozniak became Chief Scientist at Fusion-io. In March 2009 - SiliconSystems announced that it has shipped over 4 million SiliconDrives integrated with the company's SiSMART technology. In April 2009 - SandForce unveiled its SF-1000 family of SSD Processors - aimed at oems building SATA flash SSDs. Its 2.5" SSD reference design kit is the fastest 2.5" SATA flash SSD on the market - with 250MB/s symmetric R/W throughput and 30,000 R/W IOPS. Fusion-io was named the #1 company in StorageSearch.com's list of the the Top 10 SSD OEMs based on search volume in Q1 2009. This was the 1st time that the #1 slot has been held by a company which does not make traditional hard-disk form-factor SSDs. In May 2009 - DDRdrive emerged from stealth mode and launched the DDRdrive X1 - a PCIe compatible RAM SSD with onboard flash backup. Load / restore time is 60S. Performance is over 200K IOPS (512B). R/W throughput is 215MB/s and 155MB/s respectively. Capacity is 4GB. OS compatibility:- Microsoft Windows (various). Price is $1,495. In June 2009 - DTS won a best of show award at Interop Tokyo 2009 for its Platinum SSD. The company says it will ship a 2.5" version of this product - which delivers about 40,000 IOPS and 250MB/s R/W - later this month. In July 2009 - STEC announced it had received $120 million order for its ZeusIOPS SSDs from a single enterprise storage customer (later confirmed to be EMC) for delivery in the 2nd 1/2 of 2009. In September 2009 - Intel said it will deploy up to 10,000 SSD notebooks this year to its own employees following an internal review of the benefits. In October 2009 - Seagate disclosed it has started sampling its 1st SSD product to major oems. In November 2009 - Fusion-io unveiled details of a very fast PCIe form factor, InfiniBand compatible, flash SSD designed for 2 undisclosed government customers. Each ioDrive Octal card, occupies 2 slots and delivers 800,000 IOPS (4k packet size), 6GB/s bandwidth and has upto 5TB maximum capacity (implemented by 8x ioMemory modules). In December 2009 - Micron announced it is sampling 6Gbps SATA MLC SSDs in 1.8" and 2.5" form factors. Micron's C300 SSD can achieve a read throughput speed of up to 355MB/s and a write throughput up to 215MB/s. | ||||||||||||||||

SSD Market History - 2010As 2010 was about to dawn I explained why I thought this would be seen as the start of the SSD market bubble. This was the first year that SSD market revenue reached billions of dollars. 2010 1st quarter - among other things...

SSD Market History - 2011 - year of the Fusion-io IPOBusiness activity in the SSD market was energized by the realization that SSD companies were worth a lot of money. Initially indicated by the valuation of Fusion-io's IPO in the 1st half of the year - a spate of acquisitions of SSD controller companies later in the year revealed that the storage industry had great expectations for the future size of the SSD market.among other things... here were the main highlights

SSD Market History - 2012 - adaptive R/W DSP IP market > 10 companiesI anticipated 2012 would be the year of the enterprise SSD market goldrush but 2012 turned out to be more complicated than that - being at the pivotal point in several long term multi-year Strategic Transitions in SSD.

2013 - a new threat and new roles for PCIe SSDsIn the 6 years leading up to 2013 - the embodiment of what was the fastest type of flash SSD which could cozy upto apps servers plugged into enterprise CPU motherboards had been PCIe SSDs. There had been indications in 2012 that PCIe SSDs could reach out and do more within the enterprise - and in 2013 we witnessed some of those anticipated changes:- such as the wider software support for "beyond the same box" clustering and fabrics for PCIe SSDs - which simplified high availability and began to encroach on SAN-like functionality - albeit at a much reduced - cabinet-like physical distance. The market for 2.5" PCIe compatible SSDs - also became served by more vendors.A new role for "slower" PCIe SSDs also began - in the shape of products designed for consumer PCs and ultrabooks. These offered latency and throughput which was vastly superior to anything which had previously been available in mainstream notebooks - which had been hampered by an over reliance on fossilized hard drive interfaces such as SATA. A new competitive pressure in the fast PCIe SSD market space also emerged this year - with the debut of a new class of motherboard SSDs designed to provide flash style capacity but designed to operate transparently within standard DRAM sockets - memory channel SSDs. For the SSD market generally one of the significant changes in 2013 was that - unlike before - new companies entering the market could rely on a sophisticated SSD ecosystem - in which key elements of their solutions were already being supplied by other companies. Here are some of the highlights and milestones for 2013 extracted from the archived SSD news for each month. In January 2013 - BiTMICRO launched a marketing program to license its Talino SSD controller. Foremay shipped 2TB industrial 2.5" SATA SSDs with standard 9.5mm thickness. In February 2013 - Virident Systems announced beta availability of a new software suite - called FlashMAX Connect - which enables a single PCIe flash card - made by the company - to service multiple servers. Skyera announced $51 million in financing led by Dell Ventures and including an investment by WD. In March 2013 - EMC said it was sampling flash arrays which are designed and managed using the big SSD controller architecture based on leveraging IP from its acquisition of XtremIO. In April 2013 - Diablo Technologies named SMART Storage as its exclusive flash partner to pioneer a new type of (faster than PCIe SSD) memory channel SSDs. Fusion-io acquired NexGen Storage (an iSCSI hybrid array IP company) for $119 million. In May 2013 - Fusion-io announced that its co-founders - David Flynn (who had been CEO and President) and Rick White (who had been CMO) have resigned and will pursue future entrepreneurial investing activities together. Micron announced it's sampling a new model in the hot swappable 2.5" PCIe SSDs market - the P420m has upto 1.4TB MLC capacity and can deliver 750K R IOPS. Micron specifies endurance as "50PB of drive life". In June 2013 - WD announced that it had agreed to acquire Stec for approximately $340 million. Stec will be absorbed into HGST. Samsung entered the PCIe SSD market - with models aimed at notebooks. In July 2013 - SanDisk announced a definitive agreement to acquire SMART Storage Systems for approximately $307 million. Samsung announced its entry into the 2.5" PCIe SSD market. Its NVMe SSD had upto 1.6TB capacity, read throughput upto 3GB/s, and up to 740K IOPS. In August 2013 - SMART Storage Systems announced it had begun sampling the first memory channel SSDs compatible with the interface and reference architecture created by Diablo Technologies. SMART's first generation enterprise ULLtraDIMM SSD (ULL = ultra-low latency) can be deployed via any existing DIMM slot and provides 200GB or 400GB of enterprise class flash SSD memory with upto 1GB/s and 760MB/s of sustained read/write performance, with 5 microseconds write latency. Pure Storage -announced it had closed an oversubscribed $150 million Series E funding round with institutional investors which brought the company's total capital raised to $245 million. In September 2013 - Micron began sampling the first implementation of the Hybrid Memory Cube. Micron's new SR (short reach) HMC provided 2GB DRAM in a BGA - with upto 160GB/s bandwidth. Violin Memory began trading on the NYSE Friday as "VMEM". The company got the money it wanted - $162 million - but those who bought at the original price didn't consider themselves quite so lucky. Business Insider commented on Violin's Awful IPO In October 2013 - DensBits announced that it has licensed its advanced Memory Modem technology (a variety of adaptive R/W and DSP flash controller IP) to Toshiba for use in new designs of SSDs. In November 2013 - LSI launched its 3rd generation SandForce SSD controller family - the SF3700 - which offered native SATA or gen 2 PCIe interfaces - and incorporated adaptive R/W DSP ECC management. StorageSearch.com described the underlying business concept as "SSD market on a chip" - and described the design as the most ambitious design of a single chip SSD controller in SSD market history. Primary Data - which had been founded less than 6 month earlier by the departure of the two cofounders of Fusion-io - announced it had secured a $50 million funding round. Maxta launched its first product - the Maxta Storage Platform - a hypervisor-agnostic software platform for repurposing arrays of standard servers (populated with cheap standard SATA SSDs and hard drives) into scalable enterprise class apps servers in which the global CPU and storage assets become available as an easily managed meta resource with optimized performance, cost and resilience. In December 2013 - LSI announced that it had agreed to be acquired by Avago Technologies Limited in an all-cash transaction valued at $6.6 billion. 2014 - In 2014 we witnessed the birth of a renaissance in SSD inspired enterprise architecture - on a scale of ambition we haven't seen since the Year of SSD Revolutions in 2007see also:- key SSD ideas in 2014In January 2014

In June 2014 - SanDisk launched a new enterprise software product - ZetaScale - designed to support large inmemory intensice applications. ZetaScale's technical roots came from the earlier acquisition of Schooner. At the time of the launch - StorageSearch.com said that ZetaScale was likely to be one of the most significant SSD software products launched in 2014. In July 2014 - NxGn Data exited stealth mode - promising it would sample M.2 form factor SSDs for the enterprise market with in-situ SSD processing APIs in 2015. In August 2014

2015 - What were the big SSD ideas of 2015?In January 2015

2016 - what were the big SSD, storage and memory architecture ideas which emerged and became clearer in 2016?The phoney war in DIMM wars ended with real products shipping. Big memory ideas about tiering and SSD management migrated from webscale all the way down to embedded low power products. It still wasn't clear which memory technologies would win the SCM DIMM wars but with a growing software ecosystem the risk of choosing the wrong hardware product didn't matter so much.In January 2016

2017 - after All Flash Arrays - what's the next box?In the first half of 2017 there were 2 background factors which surfaced in many stories related to the SSD market.

In January 2017

In July 2017 - Viking began shipments of 50TB planar MLC 3.5" SAS SSDs (the highest capacity drives in that form factor) based on a controller platform designed by rackmount SSD maker Nimbus. In August 2017 - A new SSD controller company - Burlywood - emerged from stealth mode and won a best of show award at the Flash Memory Summit. In September 2017

2018 - QLC SSDs ship, tariff barriers and new ways of leveraging layers in 3D nandIn January 2018.

In April 2018

In June 2018 - GridGain began beta sampling its in-memory cache as a cloud service. In July 2018 - Intel and Micron agreed to a parting of the ways on future 3DXPoint development. Upto that point Micron had seen minimal revenue from 3DXPoint whereas the potential of developing a software ecosystem centered around this technology had strategic lock-in attractions for Intel regardless of near term memory sales. Zsolt Kerekes - founding editor of StorageSearch.com suggested "the memoryfication of processors and the flattening of latency by SSD infrastructure means that traditional complex multi level cache server processors are wasteful... and that due to trends in memory accelerators for the memory defined software market... memory and processor companies (like Intel and Micron) will have more reasons to become competitors rather than collaborators in strategic designs in the cloud." In August 2018 - Marvell began sampling the first NVMe-oF SSD Converter Controller. aimed at a EBOF (Ethernet Bunch of Flash) applications. In September 2018 - SNIA (Storage Networking Industry Association) entered the computational storage market. In October 2018 - DRAMeXchange (a market research company which tracked memory and SSD price trends) said the supercycle of DRAM price growth - which had lasted for 9 consecutive quarters - was over. (See boom bust cycles in the memory market for other historic examples and perspectives.) In November 2018 - SMART Modular demonstrated a 96GB Gen-Z Memory Module which was implemented in a PCIe form factor and used bridging technology based on IntelliProp's Mamba fabric memory controller. | ||||||||||||||||

| ||||||||||||||||

| understanding SSD history? footnote by Zsolt Kerekes, editor StorageSearch.com (1998 to 2018) A you can see above - a lot of stuff happened in SSD history. How do you make sense of that today? Take a look at may last major article about the SSD market (written October 2018 prior to retirement) - 4 ways to split SSD history into "before and after" to understand now what next? | ||||||||||||||||

| ||||||||||||||||

| About the publisher - 27 years of enterprise buyers guides. |

| ||||||

| . | ||||||

| ||||||

1999 - SSD market exceeds 10 active oems for the first time 2000 - world's first online ads for enterprise SSDs 2001 - 3.5" SCSI flash SSDs have 14GB capacity 2002 - 1st NAS flash SSD 2003 - terabyte SSD systems become commercially available 2004 - StorageSearch.com asks - what do SSD buyers want? 2005 - Samsung declares SSDs to be a strategic market ...........first shipments of SAS SSD storage (server based SDS) 2006 - SSD awareness flares into notebooks 2007 - PCIe SSD shipments begin in enterprise ...........first designs of 3.5" SAS SSDs unveiled ...........enterprise flash IOPS can replace entry level RAM SSDs 2008 - SSD market reaches 100 active SSD companies 2009 - SSDs match hard drives in capacity at 2.5" terabyte level 2010 - SSD revenue reaches billions of dollars ...........first fizz of the SSD market bubble 2011 - SSD software becomes useful ...........market excitement from Fusion-io's IPO 2012 - EOL for RAM SSD market (SSD is flash), ...........adaptive R/W DSP flash vendors passes 10 companies 2013 - integrated rack level SSD technology beats the sum of the parts ...........SSD software promises to become gateway for all data ...........DRAM DIMMs is new form factor for fast flash SSDs ...........SSD ecosystem - negates need to invent everything by new startups 2014 - in-situ SSD processing ........... PCIe SSD market re-energized with 2.5" and M.2 ........... random access memory doesn't have to be RAM ........... 3D nand flash -may be tough enough for industrial markets 2015 - retiring and retiering DRAM was one of the big new SSD ideas 2016 - NVMe over Fabric, memory systems customization, etc 2017 - Shortages in legacy memory made "emerging nvms" look better 2018 - First QLC SSDs ship. MRAM retention got 1,000x better. | ||||||

| ... | ||||||

| ||||||

... | ||||||

| ||||||

... | ||||||

| ||||||

...... | ||||||

| ||||||

.... | ||||||

| ||||||

... | ||||||

| ||||||

... | ||||||

| ||||||

... | ||||||

| ||||||

... | ||||||

| ||||||

... | ||||||

| ||||||

... | ||||||

| ||||||

... ... | ||||||

| ||||||

. | ||||||

| ||||||

. | ||||||

| ||||||

. | ||||||

| ||||||

. | ||||||

| ||||||

... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... | ||||||

| ||||||

... ... ... ... | ||||||

| ||||||

... ... ... ... | ||||||

| ||||||

... ... ... ... | ||||||

| ||||||

... ... ... ... | ||||||

| ||||||

... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... | ||||||

| ||||||

... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... | ||||||

| ||||||

... ... ... ... ... ... | ||||||

| ||||||

... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... | ||||||

| ||||||

... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... | ||||||

| ||||||

... ... ... ... ... ... ... ... ... ... ... ... ... ... before and after... ... ... ... ... ... ... ... ... ... ... ... ... ... ... | ||||||

| ||||||

... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... | ||||||

|