|

|

| ..... |

SSD history is a mess.

I know I was there and I wrote the first draft of it.

But

there is an easy way to get the lessons of all that history of technical change

and market adoption by looking at 4 strategic before and after events. |

| strategic

bifurcations in SSD market history | | |

| ..... |

by

Zsolt Kerekes

- editor StorageSearch.com

There's

one kind of market research report which you won't find listed on the website

of any storage market report vendor - and that's a directory of all the other

market research companies they compete with! Here's my list - compiled from

over 20 years of

past news

stories - which includes all categories of market research companies... |

- Storage Clairvoyants - predict the future

- Terabyte Talliers - tell you what's already happened

- Storage SoothSayers - make your

PR sound more

credible...

|

|

|

. |

|

. |

| Who are the top SSD

companies? ... the companies which you absolutely have to look at if you've got

any new projects involving SSDs? |

| the Top SSD Companies | | |

. |

|

|

|

.

. |

|

| |

|

| ..... |

news about storage market trends |

what happened in SSD Year

2018?

Editor:- November 11, 2018 - there's a new article on StorageSearch.com -

SSD Year 2018

- 3 things which have already happened and 1 which hasn't (yet). ...read the article

DRAMeXchange says - supercycle of DRAM price hikes is over

Editor:-

October 9, 2018 -

DRAMeXchange today

reported

how it's interpreting memory pricing and supply trends.

Re DRAM

- DRAMeXchange says:-

- DRAM products have begun to see a weak price trend, showing only a 1~2% QoQ

hike in contract prices for 3Q18 due to the continued oversupply, despite the

coming of holiday sales season. DRAMeXchange expects the quotations of DRAM

products to decline by 5% or more QoQ in 4Q18, terminating the super cycle of

price growth for 9 consecutive quarters.

- DRAM manufacturers all expect a high possibility of oversupply in 2019.

Therefore, they have tried to postpone or slowdown the capital expenditure and

capacity expansion.

- For 2019, DRAMeXchange expects the annual bit output to increase by nearly

22%.

re nand flash - DRAMeXchange says:-

- nand flash experienced a price drop of around 10% in 3Q18 and expects a

steeper drop of 10~15% in the fourth quarter, considering the impacts of trade

war. Contract prices of 3D TLC NAND Flash chips in the channel market may even

drop by more than 15% in 4Q18.

- The nand flash market is influenced by the sluggish demand for consumer

electronics, while demand for the more profitable Enterprise SSD from servers

and data centers remains stable. However, the competition among Enterprise SSD

suppliers will become increasingly fierce; hence the prices of Enterprise SSD

are very likely to continue decreasing in 2019.

- On the supply side, nand flash suppliers have raised their output forecasts

as they have expanded their production capacity and improved the yield rates of

their 64/72-layer 3D NAND production.

See also:- storage

market research directory

Clarifying SSD Pricing

- where does all the money go?

a simple

guide to semiconductor memory boom-bust cycles

2 new reports on the SSD market

Editor:- September

30, 2018 - Forward Insights

has published 2 new reports related to the SSD market:-

China's Solid State

Drive Market , and Storage

Class Memories.

new Digital Storage for Media and Entertainment Report

Editor:- August 27, 2018 - Coughlin Associates

today announced the availability of its new (14th annual)

Digital

Storage for Media and Entertainment Report - 2018 - (254 pages, $7,500).

Editor's

comments:- Among other things the press release about the new report includes

these interesting observations:-

- By our estimates, professional media and entertainment storage capacity

represents about 4.5% of total shipped storage capacity in 2017

- In 2017 we estimate that 71% of the total storage media capacity shipped

for all the digital entertainment content segments was in HDDs, with digital

tape at 22.7%, 4.3% optical discs and flash at 2.0%. Flash memory dominates

cameras and is finding wider use in post production and content distribution

systems.

- Overall cloud storage capacity for media and entertainment is expected to

grow about 13.3X between 2017 and 2023 (5.1 EB to 68.2 EB)

See

also:- a timeline of SSDs

in tv and media

new report lists malware attack vectors for memory in

processors

Editor:- June 14, 2018 -

Security

Issues for Processors with Memory is a new report (90 pages, $975) by Memory Strategies International

with ramifications (I had to use that word) for the memoryfication of processors

market.

The report includes a comprehensive list of the dimensions in

which security can be attacked and outline of design mitigation directions.

Among other things the scope includes:- "Issues of volatile

vs. non-volatile memory for cache and main memory involve consideration of

security hazards. Cryptography in multicore coprocessor systems are an issue.

Security of data on network buses is critical for military, medical and

financial systems with remedies suggested for replay attacks..." ...see more

about this report

See also:-

is data

remanence in persistent memory a new risk factor?,

optimizing

CPUs for use with SSD architectures,

SSD security,

PIM, in-situ processing

and other SSD jargon

DRAM market - update from IC Insights

Editor:- March

6, 2018 -

Are

the Major DRAM Suppliers Stunting DRAM Demand? asks the

2018 McClean

Report by IC Insights.

"In 2017, DRAM bit volume growth was 20%, half the 40% rate of increase

registered in 2016. For 2018, each of the 3 major DRAM producers (e.g.,

Samsung, SK Hynix, and Micron) have stated that they expect DRAM bit volume

growth to once again be about 20%. However monthly year-over-year DRAM bit

volume growth averaged only 13% over the 9-month period of May 2017 through

January 2018." ...read

the article

Nanya presents overview of the memory market

Editor:-

December 14, 2017 - An overview of the $120B (in 2017) memory market - which

consolidates data from various market research sources appears in a

Presentation

to Analysts and Investors (pdf) - published today by Nanya Technology .

In

2017 worldwide revenue of DRAM was approx $69B - up 67% YoY.

In 2018

worldwide wafer starts for DRAM will increase moderately to 1,210K/month.

AFA market revenue grew to $1.6B in 3Q17 - says Dell'Oro

Editor:-

December 6, 2017 - "AFA market revenue grew 33% yoy in 3Q17, reaching

$1.6 Billion" according to a new report -

Storage

Systems Quarterly - published by Dell'Oro

Group.

"All Flash Array is a very important technology

segment in external storage. In fact, as a percentage of external storage

revenue, it has been growing dramatically—from 22% in 3Q16 to 28% in 3Q17.

So every vendor is determined to expand their position in all-flash storage

systems" said Jimmy

Yu, VP at Dell'Oro Group.

Editor's comments:- Dell'Oro's press

release lists the 5 biggest vendors and the company can provide more analytical

data in their purchaseable reports.

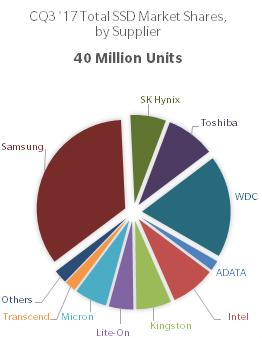

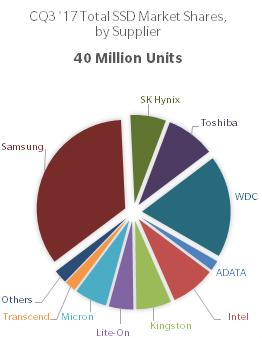

PCIe SSDs (enterprise and notebook M.2) did well in Q3

Editor:-

November 15, 2017 - TrendFocus

today published

SSD

market shipment data for Q3 2017.

Only one segment, enterprise

PCIe, saw unit growth where every other segment – client drive format

factor, client modules, enterprise SATA and enterprise SAS, all declined from

the prior quarter.

The

enterprise SSDs market declined 7% Q-Q, which includes

SATA,

SAS and

PCIe. The bright spot

within this overall decline was the healthy 15.6% increase in PCIe units. As

hyperscale companies continue to migrate away from SATA, PCIe should continue to

grow in both units and exabytes. SATA, still the highest volume of all

enterprise categories, managed to stay just above 4 million units shipped but

did decline sharply in CQ3. However, exabytes shipped in the SATA SSD market

grew due to the transition to higher capacity units. SAS SSDs now represent the

lowest unit volume of the enterprise SSD segments, but still maintain a large

lead in average capacity shipped at over 2.1 terabytes. The

enterprise SSDs market declined 7% Q-Q, which includes

SATA,

SAS and

PCIe. The bright spot

within this overall decline was the healthy 15.6% increase in PCIe units. As

hyperscale companies continue to migrate away from SATA, PCIe should continue to

grow in both units and exabytes. SATA, still the highest volume of all

enterprise categories, managed to stay just above 4 million units shipped but

did decline sharply in CQ3. However, exabytes shipped in the SATA SSD market

grew due to the transition to higher capacity units. SAS SSDs now represent the

lowest unit volume of the enterprise SSD segments, but still maintain a large

lead in average capacity shipped at over 2.1 terabytes.

Client SSD

shipments fell 4.5% sequentially but exabytes shipped was flat. Client modules

now represent almost 2/3 of all client SSDs shipped. Even more impressive within

this segment is that M.2

PCIe is now 50% of this segment – illustrating the continued migration for

major Notebook

OEMs to integrate with this interface.

3D NAND accounted for more than

50% of all bits shipped for the first time in CQ3, as all of the NAND suppliers

are well into the transition.

new report sizes NVDIMM market at 12 million units in 2021

Editor:-

October 19, 2017 - October 22, 2017 - Objective Analysis

opined today that the market for NVDIMMs is poised to grow at a 105% average

annual rate to nearly 12 million units by 2021.

This forecast is a part of the company's new 80-page report titled -

Profiting

from the NVDIMM Market (outline pdf), single user price

$6,500

- which among other things predicts unit and revenue shipments through 2021.

See also:- hybrid

DIMMs - market timeline,

Memory Channel

SSDs, market research

- storage

hyperscale is nearly 1/4 of all enterprise storage revenue

Editor:-

September 14, 2017 - A new

report

from IDC confirms

the growing size of the enterprise storage systems market related to

hyperscale datacenters. Sales by ODMs to the hyperscale segment grew 73.5%

year over year to $2.5 billion in in the 2nd quarter 2017 to reach nearly a

quarter of the entire $10.8 billion in all segments.

Editor's

comments:- 5 years ago in my article -

the big market impact

of SSD dark matter - I wrote about the future importance of web scale and

cloud companies to the development of the enterprise SSD market. These users

have been leading the curve in mainstream storage and memory architecture

adoption because they get immediate cost. benefits from

efficiency oriented

designs.

These changes in

storage

market segmentation have also encouraged new

rackmount SSD

vendors to nurture significant business ambitions with unbloated lean product

catalogs while ignoring traditional (declining) legacy markets.

miscellaneous consequences of the 2017 memory shortages

Editor:

- September 7, 2017 - This has been a year like no other in the 40 year

SSD market

experience. In a new blog on StorageSearch.com

- miscellaneous consequences of the

2017 memory shortages - I look at the pain points and share with you my

analysis of where I think the big fixes to the memoryfication market

challenges will come from. The time lag for a market fix can be understood

better if you appreciate that the speediest mitigation won't come from the

wafer fabs. ...read the article

among the awards at FMS

Editor:- August 11, 2017 -

With so many things going on in the SSD and memoryfication markets the

best

of show award winners category at the annual Flash Memory Summit has - in

past years - provided a useful way to filter interesting developments. And

this year is no exception. Among the many awards - 2 things caught my

attention:-

- IO Determinism - won an award for Toshiba and Facebook.

Although by no means a new virtue within benchmarking nevertheless the

recent award has refreshed the idea with a new spin. read

more about it

You might say that what the 2 different awards

above share in common is the desire for predictability in environments

which are beset by highly chaotic elements.

IC Insights reports record breaking memory ASPs

Editor:-

July 20, 2017 - A recent

research

note about the memory market by IC

Insights puts an interesting spotlight on memory shipments.

Among

other things IC Insights says:- "DRAM, unit shipments are actually

forecast to show a decline this year. Moreover, NAND shipments are forecast to

increase only 2%."

When

it comes to price expectations IC Insights says this.

"Even

though DRAM ASP growth is forecast to slow in the second half of the year, the

annual DRAM ASP growth rate is still forecast to be 63%, which would be the

largest annual rise for DRAM ASPs dating back to 1993 when IC Insights first

started tracking this data. The previous record-high annual growth rate for

DRAM ASP was 57% in 1997. For NAND flash, the 2017 ASP is forecast to increase

33%, also a record high gain. (In the year 2000, the predominantly NOR-based

flash ASP jumped 52%).

For those who need much more information IC

Insights publishes a 250 page report ($4,090) which includes various free

monthly updates. ...read

more

Editor's comments:- One message to take away from this is

that as memories have been transitioning to the next multiple of 3D layers the

chip throughput from the industry's legacy wafer fabs has stayed the same or

gone backwards due to the extra time taken to reliably make those extra layers

to create higher bit density memories.

TrendFocus reports sequential decline in raw storage drive

capacity sold in Q1 2017

Editor:- May 16, 2017 - TrendFocus today

announced

market highlights related to storage drives in Q1 2017.

The number

of exabytes shipped in HDDs and SSDs fell sequentially by 5% but was 19%

higher than the year ago period.

TrendFocus says several factors

contributed to the decline:- including weak PC sales, cyclicality in data

center spending, and tight NAND supply affecting SSD buying patterns.

Re

delays in storage spending in data centers:- TrendFocus says...

"Some

large hyperscale/data

center companies purchased fewer HDDs and SSDs in the quarter, temporarily

slowing exabyte growth in the segment responsible for driving the highest

long-term rate of capacity demand."

Editor's comments:-

whereas higher prices of flash SSDs due to fab production capacity

constraints and lower than expected yields in new memories has undoubtedly

been a significant factor in the market - another thing to keep your eye on is

the potential for big users to get more use out of the same raw capacity by

using newer software.

That's a factor which can surprise the market

at any time as I discussed in my warning article about the

impact of the SSD

software event horizon.

Another long term trend which will depress

storage drive sales will be the refocus on

memoryfication

architectures.

I'm not going to attribute this 5% decline in

raw storage drive byte shipments to the adoption of new memory

architectures. It's probably just a correction with many causes.

But

looking ahead to the next several future years you should not be surprised to

the impacts on the storage drive market which could be much higher.

low yield at sub 20nm is root of DDR4 shortage says DRAMeXchange

Editor:-

April 14, 2017 - Quality problems in

DRAMs which have been

sampling this year at the new sub 20nm generation from major suppliers is at

the heart of the issues discussed in a new -

market

view blog by DRAMeXchange - which concludes that the contract prrice

of 4GB DDR4 DRAM modules will rise 12.5% entering 2Q17.

Avril Wu,

research director of DRAMeXchange said - "PC-OEMs that have been

negotiating their second-quarter memory contracts initially expected the market

supply to expand because Samsung

and Micron have

begun to produce on the 18nm and the 17nm processes, respectively. However both

Samsung and Micron have encountered setbacks related to sampling and yield, so

the supply situation remains tight..." ...read the

article

2017 will be crossover revenue year for DDR4 says IC Insights

Editor:-

April 13, 2017 - A new

report

about the DRAM market by

IC Insights

says:-

- DDR4 prices in 2016 fell to nearly the same ASP as DDR3 DRAMsAs a result,

IC Insights expects DDR4 to become the dominant DRAM generation in 2017 with 58%

market share versus 39% for DDR3.

- Following a year of extraordinary gains in pricing, a boost to DRAM supply

in the second half of 2017 could lead to reduced ASPs and the inevitable start

of a cyclical slowdown in the DRAM market.

...read

the article

Are we there yet?

Editor:- April 7, 2017 - After

more than 20 years of writing guides to the SSD and memory systems market I

admit in a new blog on

StorageSearch.com -

Are

we there yet? - that when I come to think about it candidly the SSD

industry and my publishing output are both still very much "under

construction". ...read

the article

NVMe market growth expectations

Editor:- March 31,

2017 - The state of the NVMe SSD and fabric market and its growth expectations

are conveniently summarized in a new presentation -

Experiences

with NVMe over Fabrics (pdf) - by Mellanox. Among other

things:-

- 40% of AFAs will be NVMe based by 2020

- shipments of NVMe SSDs will grow to 25+ million by 2020

- 740,000 NVMe over Fabrics adapters will be shipped by 2020

This

paper captures current expectations for how the market is expected to grow.

...read

the article (pdf)

Flash Memory Market $37 billion in 2016

Editor:-

March 29, 2017 - Revenue for the worldwide

flash memory market rose

10% year on year to about $37 billion in 2016 - according to a report by Web-Feet Research

which also says that the memory industry is in its first period of not being

able to supply enough products since the year 2000. ...more in SSD news

Fastest Growing Storage Companies in 2017?

Editor:-

March 25, 2017 - 3 SSD companies were among those listed in a new article -

10

Fastest Growing Storage Companies 2017 - by Silicon Review .

Editor's

comments:- all 3 companies operate in the

rackmount SSD market

- which is an interesting indicator of where the action is. There's still

everything to play for for as the market is still still

"under

construction".

Toshiba was fastest growing SSD vendor in 2016 says IDC

Editor:-

March 8, 2017 - The flash business unit of Toshiba - which may be

called something different depending when you read this - has

announced

that its SSD business

was the 4th largest by market share and the fastest growing (year on year) in

2016 according to data in a report -

Worldwide Solid

State Storage Quarterly Update, CY 4Q16 ($40,000) - published recently by

IDC.

who's well regarded in networked storage?

Editor:-

February 1, 2017, 2017 - IT Brand Pulse

today

announced

the results of its recent survey covering brand perceptions in the networked

storage market.

Among other things:- "By nearly a 2-to-1 margin,

Seagate, outperformed second-place challenger (Western Digital) to capture its

5th Market Leader award for Enterprise HDDs.)" ...read

the article

NVDIMM market report

Editor:- January 11, 2017 - The

NVDIMM market is estimated to grow at 64% CAGR over the course of 2016 to

2020 according to 9Dimen

Research who recently published a report

Global NVDIMM Industry

2016, Trends and Forecast Report ($2,850, 153 pages).

See

also:- hybrid

DIMMs market timeline,

memory channel

SSDs

BCC predicts $850 million market for carbon NRAM in 2023

Editor:-

December 9, 2016 - BCC Research

today

announced

a report -

is

NRAM Creating Market Volatility?

- which among other things - predicts the size of the NRAM market

based on technology developed by Nantero.

In

the preamble BCC says...

"Can you give us a small peek at why

NRAM will hold the advantage vs. Flash, SRAM and DRAM in the coming years? -

The key word is breakthrough. With NRAM we depart the world of silicon and

embrace cell phones, laptops and even an internet, that is increasingly going to

become carbon based organisms. Smaller components that work faster but require

less energy are absolute winners."

See also:-

flash and alt nvms

NVMdurance compiles list of flash memory forecasts

Editor:-

December 31, 2016 - How big is the flash market?

One company with a

particular interest in that is

NVMdurance

whose light runtime footprint

endurance

expanding firmware technology can be applied to almost any kind of

nand flash as an

alternative (or companion) to more heavy weight

controller derived

adaptation

techniques.

So if you're looking at flash market sizing data take a

look at NVMdurance's new

flash memory

forecasts page which lists headline numbers from an assortment of market

data sources.

Databeans expects growth in 2017 mil / aero semico market

Editor:-

November 16, 2016 - A new blog by Databeans -

a

Turn Around on the Horizon for Mil/Aero says it expects revenue for

semiconductors used in the military and aerospace market to grow by 8%

in 2017. ...read

the article

See also:-

military SSDs - news and

articles

SSDs outsell HDDs in European storage distribution channels

Editor:-

October 18, 2016 - "Revenues from sales of oem SSDs through Western

European distribution channels in September 2016 again exceeded revenues from

oem HDDs" - is the key message from a

research

note posted by Mehari

Goitom, Enterprise Account Manager - Context World.

Mehari

says - "This confirms SSDs as the leading storage technology in the

dedicated storage market for the 3rd calendar quarter as large enterprise

customers use them to replace HDDs." ...read

the article

New ingredients in the mix for storage market clairvoyants

Editor:-

July 20, 2016 - What do you predict will happen in the storage market in the

future? And how "real" are some of the newer technologies that you

read about in web pages like this?

As a technology publisher for over

20 years I've been fortunate to have my own advance signals like talking to

company founders, investors emails, web stats and inquiries about advertising

for future product lines. And I use those to guide my priorities within the

lanes that I write about.

Gerard Blokdijk

CEO of The Art of Service

(based in Brisbane Australia) has published a new market research report -

Storage

Technologies predictive analytics report ($97) which evaluates 36

storage-related hardware and software technologies in terms of their business

impact, adoption rate and maturity level to help users decide where and when to

invest.

"Data sources include trend data, employment data,

employee skills data, and signals like advertising spent, advertisers,

search-counts, instruction and courseware available activity, patents, and books

published."

Editor's comments:- As a publisher who has

helped to accelerate the adoption of new technologies by writing about them I

have often said that new technologies become real when you see them

advertised because

editorial, and trade show activity in the storage market often precedes by

3 to 5 years the general availability of innovative new products which

you can buy.

The Art of Service's inclusion of employment signals

and product ads into the analysis mix sounds like a useful methodology

difference compared to reports and trackers seen in this market before.

See also:- who does storage market

research?

enterprise PCIe SSD shipments grew 16% Q-Q

Editor:-

May 18, 2016 - TrendFocus

today announced

publication of its

Q1

2016 nand/SSD quarterly market report.

TrendFocus says the

enterprise SSD market saw growth in all segments -

SATA,

SAS, and

PCIe.

For

enterprise SATA SSDs, unit growth compared to the previous quarter was 5%,

while SAS and PCIe saw higher growth at

6.7% and 16.3%, respectively.

Editor's comments:-

In Q1 2016 SSD shipments reported by TrendFocus were 30 million units.

Compare this to Q1 2014 for which period TrendFocus reported

15

million units. This shows SSD shipments over all markets have doubled in 2

years.

enterprise SSD petabytes doubled in China in 2015

Editor:-

March 15, 2016 - Gregory

Wong, President,

Forward

Insights says that Enterprise SSD petabytes doubled YoY in the China

market in 2015. While at the same time - shipments of all types of SSDs grew 3x

faster in the China market than the overall worldwide market.

Editor's

comments:- Greg was coy about giving me exact numbers when I asked - which

is why you got ratios instead in the story above - but you will be able to

find raw numbers in his new report -

Opportunities in

China's SSD Market - which will be published next month. Whoops - I forgot

to ask the price. Most of Forward Insights'

past SSD reports

have been in the region from aroung $5K to $10K.

top storage companies by revenue

editor:- February

5, 2016 - StorageNewsletter

recently compiled a list of the

Top

12 Storage Companies in 2015 (ranked by revenue).

This isn't the

same as top SSD companies (by revenue or search volume) but there will be a

degree of convergence between the 2 during the

next

5 years.

Back in January 2001 I launched a series called the The

10 biggest storage companies - in which I tried to predict 2 years in advance

who the top 10 would be (based on revenue).

That worked surprisingly

well - but I EOLed the series when my primary focus became SSDs.

Interesting

looking back that in 2001 Dell

wasn't regarded by most people in the market as a serious storage company - and

including them in my list stirred the enterprise pot.

IHS names 3 enterprise SSD billion dollar revenue companies

Editor:-

November 20, 2015 - Earlier this year I promised you a $billion / year

enterprise SSD companies list (which I haven't done yet).

If you

can't wait (and like short lists) then IHS

has done this already for enterprise SSD drives (which excludes

rackmount flash

systems).

IHS's list of enterprise SSD billionaires include 3

companies:-

You

can see the numbers in a new article

here

(on Electronics360).

Among other things it says "IHS

forecasts that the SSD market to pass $13 billion in revenues this year and will

surpass HDDs in revenue by 2019 with $20.8 billion versus $19.6 billion."

As you may recall I said something similar (the SSD market will be

bigger in revenue than the HDD market ever was) in my 2012 article -

How will the hard

drive market fare... in a solid state storage world?

3D X-Point could shrink DRAM market by 1/3 in 5 years

Editor:- October 23 , 2015 - Coughlin Associates

has recently published a new

report on Emerging Non-Volatile Memory and Spin Logic (163 pages,

$4,000).

The memories addressed in this report

overview

(pdf) include PRAM, RRAM, MRAM, STT MRAM as well as the recently announced

3D X-Point Technology.

3D X-Point Technology will have a big impact

on DRAM growth (with DRAM

sales down $6.7 billion to $15.6 billion due to XPoint by 2020) with XPoint

revenues of $663 million to $1.5 billion by 2020.

MRAM and STT MRAM

revenue is estimated at $1.4 billion to $3.2 billion by 2020. Manufacturing

equipment revenue for MRAM and STT MRAM production is estimated to be between

$159 million and $294 million by 2020.

DCIG publishes new edition of its AFA Buyers Guide

Editor:-

September 30, 2015 - DCIG

recently

announced

a new edition of its All-Flash Array Buyer's Guide (60 pages, free signup)

which - from a desk based research stance - describes, comments on, and

compares in depth the features of key products in this category from 18

selected vendors in the market (AMI, Dell, EMC, Fujitsu, HDS, HP, Huawei, IBM,

iXsystems, Kaminario, NetApp, Nimbus Data, Oracle, Pure Storage, SolidFire,

Tegile, Violin Memory and X-IO).

Editor's comments:- One of

the roles for this document which DCIG suggest is as a "short list"

for quickly and conveniently getting your hands on consistently-presented,

in-depth datasheets for a market snapshot of products from a range of credible

sources.

As to how the sample list of vendors is cast - DCIG clearly

stated they do not merely rely on vendors paying them for inclusion in the

list. Nevertheless one of the problems with the authority of any "buyers

guide" is the degree of inclusivity and (by implication) the

transparency of filtering criteria.

When you include hundreds of

products in such a guide from all known vendors - then the sampling process is

transparent (and those not in the guide - need to make better efforts to

communicate with their market) but when you have a guide which samples only a

small percentage of vendors then inevitably questions get asked about how those

in the sample were chosen.

My guess on the representational value of

the companies listed in the guide is that it's compatible with the kind of

shortlist you'd get by sampling from 3 broad criteria.

- companies added into the list based on public revenue criteria and

corporate brand strength (to ensure inclusion of older, long established

storage companies)

- companies added into the list based on search strength, or social media

derived ranking rather than revenue (to ensure sampling of some newer

companies)

- companies added into the list for arbitrary reasons (maybe they've got a

particularly interesting feature which the authors want to discuss as a

counterpoint to others, or maybe the authors have some special relationship

with the company which means they know more about it)

It took me about

30 seconds after seeing DCIG's vendor list that the above (or some reverse

analysis thought process like it) is probably as good an explanation as any

for DCIG to have constructed its list.

I'm not saying that's how

they did it. But if you had to construct a vendor list of reduced size (and

DCIG does have to because - due to their format - it would be cumbersome,

repetitious and wasteful of analyst time to scale the guide to hundreds of

vendors) this is as good a way as any other - for the purpose of discussing

representational features in the AFA market.

So in that respect

(unlike others) I don't have any quarrel with the sample they've chosen.

It

sure wouldn't be my list. But DCIG's authors are aiming to produce a different

kind of guide and they see their added value as coming from their proprietary

vendor scoring criteria. And that necessitates a different kind of list.

In

a free competitive market - reports compete for your attention - just as much

as products. And you don't have to like every feature to learn something

useful from them.

DCIG's scoring criteria is where I part company

with DCIG's thinking. And this is a gulf I can't bridge.

I just have

to look away from these pages to prevent my crystal ball cracking for reasons

I explained when discussing an earlier version of this guide back in

March 2014.

I think the scoring concept intrinsically suggests a much more

stable, restricted and naive model of the SSD enterprise than is currently the

case. In some respects the scoring concepts are like a bridge too far and

sometimes to the wrong places and sometimes entirely missing some critical

destinations.

Nevertheless I'm sure DCIG's new guide will serve

adequately for many people who see things the same way as the guide

creators do and who like their way of doing things. So I'm sure there

will be more editions of this guide in future.

It's not DCIG's fault

that the enterprise SSD market resembles at times the navigational uncertainty

of Lost in Space (tv series) when in the very first episode the rocket

gets hit by a meteor storm.

In the SSD market we've been through a

whole bunch of similar cosmic disturbances and our rocket was launched with no

clear destinations in mind at the outset. The best we can hope for is plausible

pragmatic reinterpretations at convenient refueking stops.

BTW - I'm

not suggesting that anyone else could do a better scoring job by using different

methodologies.

Instead what I'm saying is that such a style of

analysis is inappropriate because of current

defects in

enterprise SSD market models and the general understanding of them.

While

that situation persists - such simplistic "winner" style guides run

the risk of advocating the essential flavor of beef to vegetarians.

new SSD market report from TMR

Editor:- September 18,

2015 - SSDs with capacities of 80GB and below accounted for approximately 36%

of the $15 billion global SSD market revenue in 2014 according to a new

market report -

SSD

Market - Trends and Forecast 2015 - 2022 ($4,795 133 pages) - published

by Transparency Market

Research - which says that Samsung, Intel and SanDisk accounted for

over 57% of market revenue

Video footage accounts for 100 Exabytes per year of new storage

Editor:-

September 17, 2015 - "Video footage accounts for 7% of the total

storage sold worldwide for any reason" - that factoid is from a paper -

Taming

the firehose of media files (pdf) by a media management company called

axle Video

In-Memory Computing market could be $23 billion by 2020

Editor:-

September 10, 2015 - "The global In-Memory Computing (IMC) market is

expected to grow from $5 billion in 2015 to $23 billion by 2020"

according to Akanksha Gandhi,

Research Associate at Research

and Markets - who has co-authored a recent report -

In-Memory

Computing Mark - Global Forecast to 2020 ($5,650, 132 pages).

"An

increasing trend toward using analytics for decision making" - is one of

the factors mentioned as likely to contribute to this 32% predicted

CAGR growth trend."

SSD market slowing down?

Editor:- June 22, 2015 - In

a new observation on the state of the SSD market -

SSD Insights Q2/15:

Slowing Down - Gregory

Wong, President, Forward Insights

said this...

"The weak PC market and tepid datacenter demand

affected shipments of SATA

SSDs in Q1/15. This was offset by strong shipments of

SAS SSDs and SSDs into

the channel which benefited from aggressive pricing, particularly in Asia."

|

|

growing user confidence

will spur enterprise flash consolidation

Editor:- April 21, 2015 -

In an

new

article today on StorageSearch.com

I look at drivers, mechanisms and routes towards consolidation in the

enterprise SSD systems market along with some other outrageous and dangerous

ideas.

"90% of the enterprise SSD companies which you know

have no good reasons to survive." ...read

the article

flash backed DIMMs - new directory on StorageSearch.com

Editor:-

October 21, 2014 - Although StorageSearch.com

has been writing about flash

backed DRAM DIMMs since the first products appeared in the market - I didn't

think that subject was important enough before to rate a specific article or

market timeline page.

That's unlike

memory channel

SSDs - which is now 1 of the top 10

SSD subjects

viewed by readers after having had its own directory page since

April 2013.

However, sometimes a

market is defined as

much by what it isn't as by what it is.

And so - to help clarify the

differences between these 2 types of similar looking storage devices (one of

which I think is much more significant than the other - but both of which are

important for their respective customers) I have today created a directory

page for hybrid DIMMs

etc - which will act as the future pivoting point for further related

articles.

Evaluator Group announces new report series for rackmount SSDs

Editor:-

September 24, 2014 -

Evaluator Group

today

announced

it's expanding its comparison report coverage (from around $2,750 for IT

end-users) related to rackmount

SSD and hybrid array

vendors.

The latest addition to EV's research area are product

analyses for 15 vendors, including:

Cisco,

EMC,

HDS,

HP,

IBM,

Kaminario,

NetApp,

Nimble,

Nimbus,

Pure Storage,

SanDisk,

SolidFire,

Tegile,

Tintri and

Violin.

"Over

the next 3 years Evaluator Group expects Solid State Storage Systems to be the

architecture adopted for primary storage," said Camberley Bates,

Managing Partner & Analyst at Evaluator Group. "Performance to reduce

latency and improve consistency, along with reliability and efficiency

functionality will drive this change. It is important IT end users understand

the trade-offs of design and technical implementation to best suit their needs."

Using

the

Solid

State Evaluation Guide to understand the critical technology characteristics

EV says IT end users can clearly identify their requirements and priorities. The

Solid State Comparison Matrix allows for side-by-side comparison of product

specifications and capabilities. Evaluator Group guides IT end users through the

process with product reviews and expertise on managing and conducting a Proof of

Concept. Evaluator Group Solid State Storage Systems coverage includes products

specifically designed to exploit the characteristics of all solid state

deployment.

What will you be getting? EV is offering a

free

evaluation copy of their report for the IBM FlashSystem to people who

sign up for it.

Editor's comments:- with so many different

architectural roles for enterprise SSDs and different user preferences - it's

unrealistic to suppose that any simple side by side product comparisons will

suit all permutations of user needs. But having said that - any reliable

information which assists

user education and

comprehension into SSD arrays is a good thing.

Some flash array

vendors - realizing the futility of expecting that users will understand what

their products do and how they will interact with the

bottlenecks

and demands of

unknowable

user installations and prederences - have instead side-stepped these delay

laden hard user selection quandries -

exaggerated by the very

real personal concerns of getting it wrong - by instead offering new

risk delineated pricing models - as described in my article -

Exiting

the Astrological Age of Enterprise SSD Pricing.

See also:-

playing the

enterprise SSD box riddle game,

storage market research,

what do

enterprise SSD users want? | |

| . |

| |

|